Understanding Deri USDT: A Comprehensive Guide

Deri USDT, a term that has gained significant traction in the cryptocurrency world, refers to a stablecoin that is backed by the US dollar. In this article, we delve into the intricacies of Deri USDT, exploring its features, benefits, and potential risks. Whether you are a seasoned investor or a beginner in the crypto space, this guide will provide you with a comprehensive understanding of Deri USDT.

What is Deri USDT?

Deri USDT is a type of stablecoin that is pegged to the US dollar. It is issued by Tether Limited, a company that aims to provide a stable and reliable digital currency. Each Deri USDT token is backed by a corresponding amount of USD, ensuring that its value remains stable and does not fluctuate like other cryptocurrencies.

How Does Deri USDT Work?

Deri USDT operates on the blockchain technology, utilizing smart contracts to ensure transparency and security. When you purchase Deri USDT, you are essentially exchanging your USD for the token. Similarly, when you want to convert Deri USDT back to USD, you can do so by selling the token back to Tether Limited.

Here’s a step-by-step breakdown of how Deri USDT works:

| Step | Description |

|---|---|

| 1 | Purchase Deri USDT using USD |

| 2 | Store Deri USDT in a digital wallet |

| 3 | Use Deri USDT for transactions or investments |

| 4 | Sell Deri USDT back to Tether Limited for USD |

Benefits of Deri USDT

Deri USDT offers several benefits, making it a popular choice among investors and traders:

-

Stability: Deri USDT’s value remains stable, providing a reliable store of value in the volatile cryptocurrency market.

-

Transparency: The blockchain technology ensures that all transactions are transparent and verifiable.

-

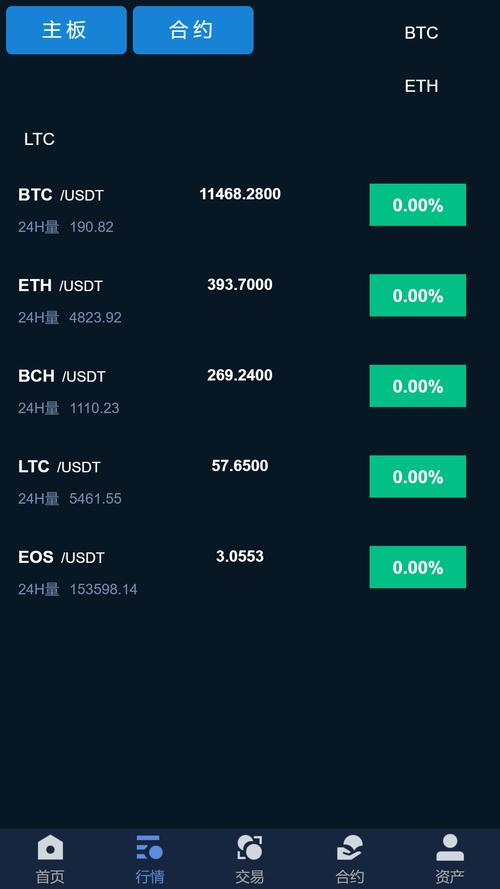

Accessibility: Deri USDT can be easily accessed and used across various platforms and exchanges.

-

Security: Smart contracts provide a high level of security, protecting your Deri USDT tokens from theft and fraud.

Risks Associated with Deri USDT

While Deri USDT offers numerous benefits, it is important to be aware of the potential risks:

-

Counterparty Risk: Deri USDT is issued by Tether Limited, and there is always a risk that the company may not have enough USD reserves to back the tokens.

-

Regulatory Risk: Cryptocurrencies, including Deri USDT, are subject to regulatory changes that could impact their legality and use.

-

Market Risk: The cryptocurrency market is highly volatile, and the value of Deri USDT could be affected by market conditions.

Conclusion

Deri USDT is a stablecoin that offers stability, transparency, and accessibility in the cryptocurrency market. While it comes with potential risks, its benefits make it a valuable tool for investors and traders. By understanding how Deri USDT works and being aware of the associated risks, you can make informed decisions about incorporating it into your investment strategy.