Crypto USDT vs BTC: A Comprehensive Comparison

When it comes to the world of cryptocurrencies, two of the most prominent players are Tether (USDT) and Bitcoin (BTC). Both have their unique features and advantages, making them popular choices among investors and traders. In this article, we will delve into a multi-dimensional comparison of USDT and BTC, covering aspects like market capitalization, liquidity, security, and use cases.

Market Capitalization

Market capitalization is a crucial factor to consider when comparing cryptocurrencies. As of the latest data, Bitcoin holds the top position with a market capitalization of over $500 billion. Tether, on the other hand, has a market capitalization of around $70 billion. This indicates that Bitcoin is the largest cryptocurrency by market cap, making it a more significant asset in the crypto market.

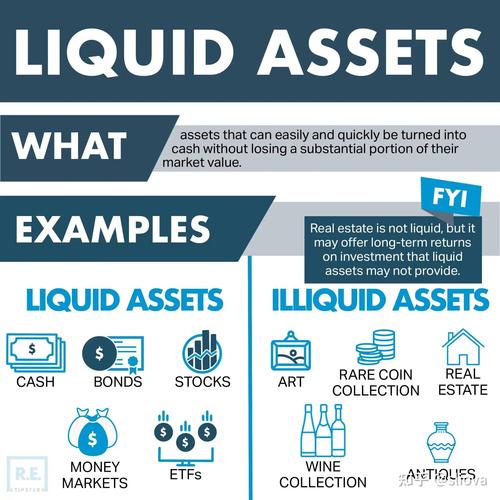

Liquidity

Liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. Bitcoin has the highest liquidity among all cryptocurrencies, making it highly tradable. Tether, being a stablecoin, also offers good liquidity, but it is not as liquid as Bitcoin. This is because Bitcoin has a larger trading volume and is widely accepted across various exchanges.

Security

Security is a vital aspect of any cryptocurrency. Bitcoin is known for its robust security features, thanks to its decentralized nature and advanced cryptographic algorithms. It is nearly impossible to hack Bitcoin, making it a secure investment. Tether, being a stablecoin, is also considered secure. However, it is important to note that Tether is centralized, which means it is subject to regulatory risks and potential manipulation by its issuer.

Use Cases

Bitcoin and Tether have different use cases, which contribute to their popularity. Bitcoin is primarily used as a digital gold, a store of value, and a medium of exchange. It has gained significant traction as a decentralized currency, allowing users to make transactions without intermediaries. Tether, on the other hand, is designed to be a stable alternative to fiat currencies. It is widely used for trading, lending, and borrowing in the crypto market.

Bitcoin is also used as a hedge against inflation and geopolitical risks. Its finite supply of 21 million coins ensures that it cannot be devalued by excessive printing, making it a preferred choice for investors looking for long-term value. Tether, being pegged to the US dollar, offers stability and allows users to avoid the volatility associated with other cryptocurrencies.

Regulatory Environment

The regulatory environment plays a significant role in the adoption and growth of cryptocurrencies. Bitcoin has faced various regulatory challenges over the years, but it has managed to gain recognition and acceptance in many countries. Governments and financial institutions are increasingly acknowledging the potential of Bitcoin and exploring ways to regulate it effectively.Tether, being a stablecoin, is subject to stricter regulations compared to Bitcoin. Its centralized nature and the fact that it is backed by fiat currencies make it more susceptible to regulatory scrutiny. However, Tether has been working to comply with regulatory requirements and has gained approval in several countries.

Conclusion

In conclusion, both Bitcoin and Tether have their unique strengths and weaknesses. Bitcoin, with its decentralized nature and finite supply, is considered a more secure and valuable asset. Tether, being a stablecoin, offers stability and is widely used for trading and lending purposes. The choice between the two depends on your investment goals, risk tolerance, and preferred use cases.When considering investing in cryptocurrencies, it is essential to conduct thorough research and understand the potential risks involved. Keep in mind that the crypto market is highly volatile, and prices can fluctuate significantly in a short period. Always invest responsibly and consult with a financial advisor if needed.

| Cryptocurrency | Market Capitalization | Liquidity | Security | Use Cases |

|---|---|---|---|---|

| Bitcoin (BTC) | Over $500 billion | High | High | Store of value, medium of exchange, hedge against inflation |

| Tether (USDT) | Approx. $70 billion | Good | Good | Trading, lending, borrowing, stable alternative to fiat currencies |