Difference of USDT and USDC: A Comprehensive Overview

When it comes to the world of cryptocurrencies, two of the most popular stablecoins are Tether (USDT) and USD Coin (USDC). Both are designed to provide stability and reliability, but they have distinct features and use cases. In this article, we will delve into the differences between USDT and USDC, covering various aspects such as their backing, market capitalization, transaction speed, and regulatory compliance.

Backed by Different Assets

USDT is backed by a combination of fiat currencies and other cryptocurrencies. Tether Limited, the company behind USDT, claims that each USDT token is backed by a reserve of assets, which includes USD, EUR, JPY, and other fiat currencies, as well as BTC and ETH. This multi-asset backing is intended to provide a level of security and stability to the token.

In contrast, USDC is backed solely by USD. Circle, the company behind USDC, states that each USDC token is backed by a full reserve of USD held in its bank accounts. This means that for every USDC in circulation, there is a corresponding dollar in a regulated financial institution.

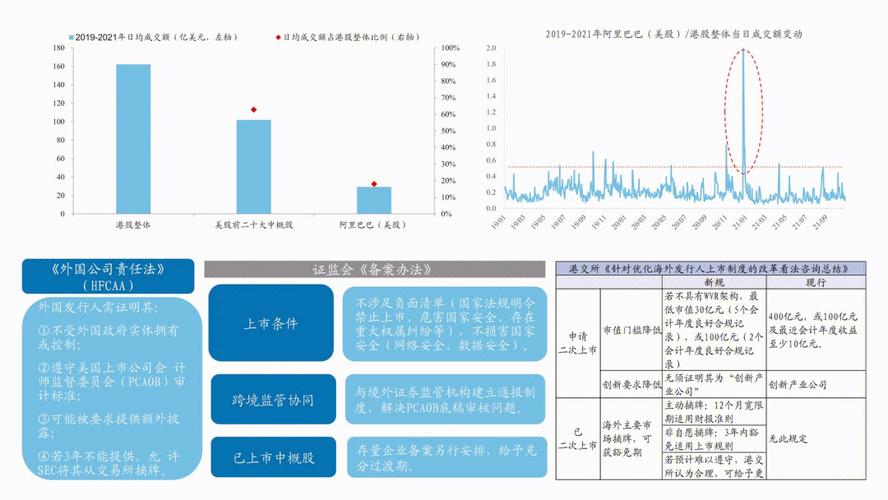

Market Capitalization

As of the time of writing, USDT has a significantly larger market capitalization than USDC. USDT is the second-largest cryptocurrency by market cap, with a value of over $80 billion. In comparison, USDC has a market capitalization of approximately $25 billion, making it the fourth-largest cryptocurrency.

Transaction Speed

USDT and USDC both offer fast transaction speeds, which are crucial for their use in decentralized finance (DeFi) applications. USDT transactions are typically confirmed within 1-2 minutes, while USDC transactions are confirmed within 30 seconds to 1 minute. Both stablecoins are built on the Ethereum network, which allows for these rapid transaction times.

Regulatory Compliance

USDT and USDC have faced varying degrees of regulatory scrutiny. Tether Limited has been under scrutiny from regulators in the United States and other countries, with concerns about the transparency of its reserve holdings and the potential for manipulation. In response, Tether Limited has taken steps to improve its transparency, including publishing weekly reserve reports.

USDC, on the other hand, has been more closely aligned with regulatory requirements. Circle has worked with regulated financial institutions and has been transparent about its reserve holdings. This has helped USDC gain a reputation as a more compliant stablecoin.

Use Cases

USDT and USDC are both widely used in the cryptocurrency ecosystem, but they have different use cases. USDT is often used for trading on exchanges, as it is accepted by many platforms. It is also popular among traders who want to avoid the volatility of other cryptocurrencies.

USDC is more commonly used in DeFi applications, where its fast transaction speed and regulatory compliance make it an attractive option for developers. Circle has also partnered with various financial institutions to integrate USDC into their services, such as payroll and remittances.

Conclusion

In summary, USDT and USDC are two popular stablecoins with distinct features and use cases. While USDT has a larger market capitalization and is widely used for trading, USDC is more commonly used in DeFi applications and has a stronger focus on regulatory compliance. Understanding the differences between these two stablecoins can help you make informed decisions about how to use them in your cryptocurrency investments and transactions.

| Feature | USDT | USDC |

|---|---|---|

| Backing | Mixed assets (USD, EUR, JPY, BTC, ETH) | USD |

| Market Capitalization | Over $80 billion | Approximately $25 billion |

| Transaction Speed | 1-2 minutes | 30 seconds to 1 minute |

| Regulatory Compliance | Under scrutiny | Strong focus on compliance |

| Use Cases | Trading, exchanges | DeFi, financial institutions |