In recent years, the cryptocurrency landscape has evolved significantly, with altcoins emerging as essential players in the market. This article delves into the concept of alternative cryptocurrencies, their significance, and the trends shaping their future.

What are Altcoins?

The term “altcoin” refers to any cryptocurrency that is not Bitcoin. These alternative coins aim to improve upon Bitcoin’s technology, offering various features and functionalities, such as faster transaction speeds, increased privacy, or unique mechanisms for decentralized applications. Some popular altcoins include Ethereum, Litecoin, and Ripple, each serving distinct roles within the digital currency ecosystem.

The Growth of Altcoins

In the wake of Bitcoin’s rise, many investors and developers have turned their attention to altcoins. Their growth can be attributed to the desire for diversification in investment portfolios and the increasing interest in blockchain technology. As more projects launch on platforms like Ethereum, the variety of altcoins continues to expand, attracting both developers and investors striving to capitalize on new innovations.

Another factor contributing to the growth of altcoins is the increasing acceptance of cryptocurrency as a legitimate financial asset. More retail and institutional investors are exploring investment opportunities in altcoins to leverage potential gains, pushing demand and market capitalizations to new heights.

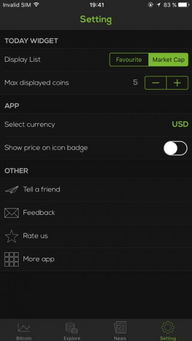

Trends Influencing the Altcoin Market

Several noteworthy trends are influencing the altcoin market landscape today, shaping its future trajectory:

-

Decentralized Finance (DeFi): The DeFi movement aims to replicate traditional financial systems through decentralized platforms, and many altcoins facilitate this by providing liquidity, governance, and other essential features.

-

Non-Fungible Tokens (NFTs): Altcoins play a significant role in the NFT ecosystem, enabling artists and creators to tokenize their work, driving demand for various tokens.

-

Cross-Chain Interoperability: Projects focusing on connecting different blockchain networks have gained traction, fostering collaboration among altcoins and enhancing their usability.

Future Outlook for Altcoins

As the cryptocurrency market continues to mature, the future of altcoins appears promising. Innovations in technology, regulatory acceptance, and growing institutional interest will likely bolster their presence in financial markets. Investors keen on diversifying their portfolios can benefit from the proliferation of altcoins, but they should remain vigilant, as the market remains volatile and risky.

In summary, altcoins represent a vital segment of the cryptocurrency market, driving innovation and investment opportunities. Understanding their features, growth, and the trends influencing them can help investors make informed decisions as they navigate the evolving landscape of alternative cryptocurrencies.