BTC USDT Fear and Greed Index: A Comprehensive Guide

The BTC USDT Fear and Greed Index is a vital tool for cryptocurrency traders and investors. It provides a snapshot of the market sentiment, helping them make informed decisions. In this article, we will delve into the details of the Fear and Greed Index, its significance, and how it can be used to gauge the market’s mood.

Understanding the Fear and Greed Index

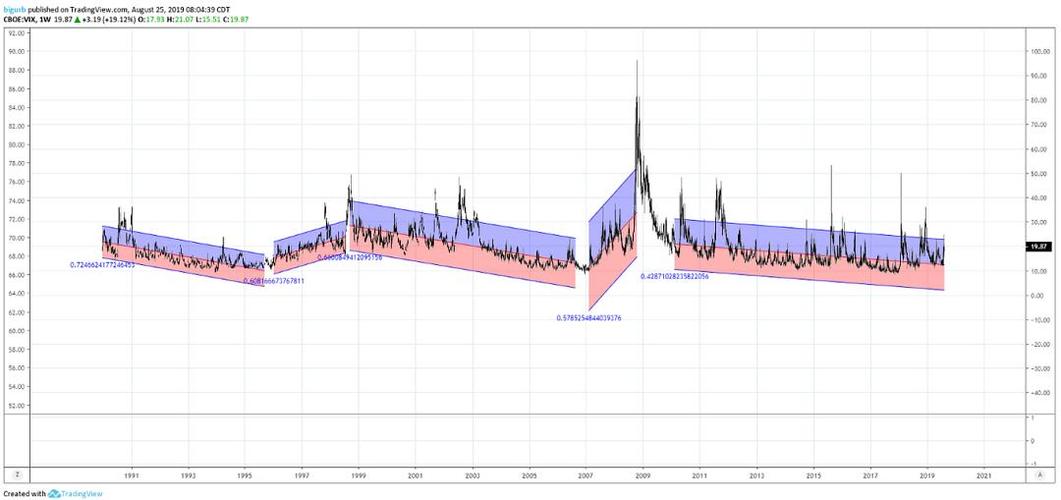

The Fear and Greed Index is a proprietary indicator developed by the website Crypto Fear & Greed. It measures the market sentiment by analyzing various factors, including social media buzz, market momentum, surveys, and volatility. The index ranges from 0 to 100, with lower scores indicating fear and higher scores indicating greed.

Here’s a breakdown of the factors considered in the index:

| Factor | Description |

|---|---|

| Social Media Buzz | Measures the level of discussion about Bitcoin and other cryptocurrencies on social media platforms like Twitter and Reddit. |

| Market Momentum | Assesses the recent price movement of Bitcoin and other major cryptocurrencies. |

| Surveys | Considers the results of surveys conducted among cryptocurrency traders and investors. |

| Volatility | Measures the historical price volatility of Bitcoin and other major cryptocurrencies. |

Interpreting the Fear and Greed Index

Understanding how to interpret the Fear and Greed Index is crucial for making informed trading decisions. Here are some key insights:

Fear (0-25): When the index is below 25, it indicates that the market is predominantly in a state of fear. This could be due to negative news, regulatory concerns, or a general lack of confidence in the cryptocurrency market. In such situations, investors may be cautious, leading to lower prices.

Neutral (25-75): A score between 25 and 75 suggests a balanced market sentiment. This range indicates that investors are neither overly fearful nor greedy. It’s a good time to analyze other factors and make informed decisions.

Greed (75-100): When the index is above 75, it indicates that the market is predominantly in a state of greed. This could be due to positive news, speculative trading, or a general overconfidence in the cryptocurrency market. In such situations, investors may be overly optimistic, leading to higher prices.

Using the Fear and Greed Index for Trading

The Fear and Greed Index can be a valuable tool for traders and investors. Here are some strategies to consider:

Contrarian Trading: When the index is in the fear zone (0-25), it may be a good time to consider buying cryptocurrencies, as prices may be undervalued. Conversely, when the index is in the greed zone (75-100), it may be a good time to consider selling, as prices may be overvalued.

Market Timing: The index can help traders identify potential market turning points. For example, if the index is in the fear zone and starts to rise, it may indicate that the market is bottoming out and a recovery is on the horizon.

Complementary Indicators: While the Fear and Greed Index is a useful tool, it’s important to use it in conjunction with other indicators and analysis. This will help you make more informed decisions and reduce the risk of making impulsive trades.

Conclusion

The BTC USDT Fear and Greed Index is a powerful tool for gauging the market sentiment in the cryptocurrency space. By understanding how to interpret the index and using it in conjunction with other indicators, traders and investors can make more informed decisions and potentially improve their trading performance.