Tether (USDT

), a stablecoin designed to maintain a stable value by pegging its worth to the US dollar, plays a crucial role in the cryptocurrency market. In this article, we will explore the current price trends of USDT, factors influencing its market value, and how it compares with other cryptocurrencies.

Understanding USDT and Its Market Dynamics

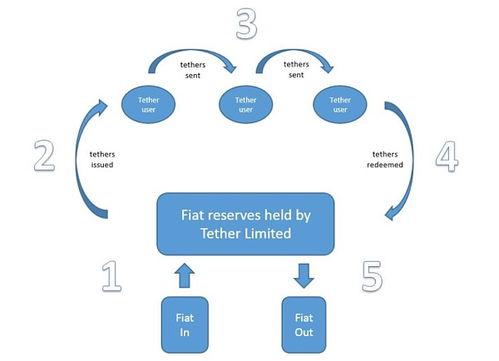

The price of USDT is largely anchored to the US dollar, hence it aims to maintain a 1:1 ratio with USD. However, market demand and supply, regulatory news, and general trends in the cryptocurrency market can cause slight fluctuations in its price. Despite being a stablecoin, it’s essential for investors and traders to keep an eye on its value, especially during periods of volatility in the cryptocurrency world.

Currently, the price of USDT may hover around

$1, but it is necessary to monitor exchanges for the most accurate real-time prices. Exchanges like Binance, Coinbase, and Kraken typically provide up-to-date pricing information. Understanding the dynamics that influence USDT’s price can aid traders in their strategic decision-making.

Factors Impacting the Price of USDT

Several factors can influence the price of Tether. These include:

- Market Sentiment: The general mood in the cryptocurrency market, whether bullish or bearish, can affect the demand for USDT.

- Regulatory Developments: News regarding regulations surrounding stablecoins can lead to fluctuations in price.

- Exchange Listings: The availability of USDT on multiple exchanges can affect its liquidity and price.

When traders anticipate a price drop in other cryptocurrencies, they often convert their assets to USDT as a protective measure, which boosts its demand and keeps its price stable. Conversely, if the market shows bullish momentum, traders may sell their USDT to reinvest in more volatile cryptocurrencies, leading to slight fluctuations in USDT’s price.

Investors should continuously analyze the market for these and other factors to maintain a strong investment strategy related to USDT.

Comparing USDT with Other Stablecoins

It is also insightful to compare the price performance of USDT with other stablecoins like USDC (USD Coin) and BUSD (Binance USD). While all these stablecoins aim to maintain a 1:1 peg with the US dollar, their adoption and usage in various markets can result in minor price variations. Keeping an eye on these competitors can be beneficial for traders looking for the most reliable stablecoin to use.

In conclusion, while Tether’s price usually remains stable around the one-dollar mark, understanding the underlying elements that can influence its value is critical for anyone operating in cryptocurrency markets. Monitoring real-time prices and staying informed about market changes will help in making educated trading decisions. By keeping these factors in mind, investors can better navigate the cryptocurrency landscape with a solid grasp of USDT’s price mechanism.