In the ever-evolving world of cryptocurrencies, stablecoins like BUSD and USDT play a crucial role in facilitating trading and providing stability amidst market volatility. This article delves into the details of BUSD and USDT on the Binance exchange, helping you understand their features, advantages, and how to utilize them effectively.

Understanding BUSD and USDT

BUSD, also known as Binance USD, is a stablecoin issued by Binance in partnership with Paxos. It is pegged to the US dollar, meaning its value is designed to remain stable at 1:1 with the USD. This stability makes BUSD an ideal choice for traders looking to minimize their exposure to market fluctuations.

On the other hand, USDT, or Tether, is one of the oldest and most widely used stablecoins in the market. Like BUSD, USDT is also pegged to the US dollar, maintaining a 1:1 value relationship. Tether has a long-standing presence in the crypto market, providing liquidity and a stable trading option for users.

The Role of BUSD and USDT on Binance

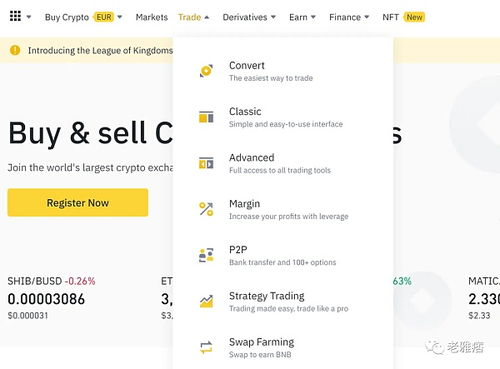

Both BUSD and USDT serve as key trading pairs on the Binance exchange. Traders often use these stablecoins to move in and out of volatile cryptocurrencies without needing to convert back to fiat currency. Additionally, BUSD and USDT can be used for various trading activities such as spot trading, margin trading, and futures trading.

- Spot Trading: Traders use BUSD and USDT to buy and sell other cryptocurrencies directly. Their stable nature allows for reliable pricing.

- Margin Trading: On Binance, users can borrow funds against BUSD and USDT to leverage their trades, increasing potential returns.

- Futures Trading: Both stablecoins can be used as collateral for futures contracts on Binance, allowing traders to manage risk effectively.

Advantages of Using BUSD and USDT

Utilizing BUSD and USDT on Binance comes with several advantages. First, both stablecoins offer high liquidity, ensuring that traders can quickly execute trades at desired prices. Second, their peg to the US dollar provides a sense of security during market downturns, allowing users to retain their capital in a stable form.

Moreover, Binance offers various incentives for using BUSD and USDT. These include trading fee discounts and earning opportunities through yield farming or liquidity pools. Additionally, both stablecoins are secure and reliable, backed by reputable issuers like Paxos (for BUSD) and the Tether company (for USDT).

In conclusion, BUSD and USDT are essential stablecoins in the Binance ecosystem, providing critical stability and liquidity for traders. Understanding their features and advantages can greatly enhance your trading experience on the Binance exchange. Whether you choose BUSD or USDT, both options offer reliable solutions for managing your cryptocurrency portfolio effectively.