Understanding USDT in India

USDT, or Tether, is a popular cryptocurrency that is often used as a stablecoin due to its one-to-one backing by the US dollar. In India, where cryptocurrencies have seen a surge in popularity, finding the cheapest way to buy USDT is a common concern. Let’s delve into the various methods available to you.

Exchanges: The Most Common Route

Exchanges are the go-to platform for most cryptocurrency traders. In India, you can find several reputable exchanges that offer USDT trading pairs. Here are some of the popular ones:

| Exchange | Minimum Deposit | Transaction Fees |

|---|---|---|

| WazirX | INR 100 | 0.1% |

| Unocoin | INR 100 | 0.25% |

| CoinDCX | INR 100 | 0.1% |

When choosing an exchange, consider the fees, the minimum deposit required, and the overall ease of use. WazirX, Unocoin, and CoinDCX are among the cheapest options in India, with transaction fees ranging from 0.1% to 0.25%.

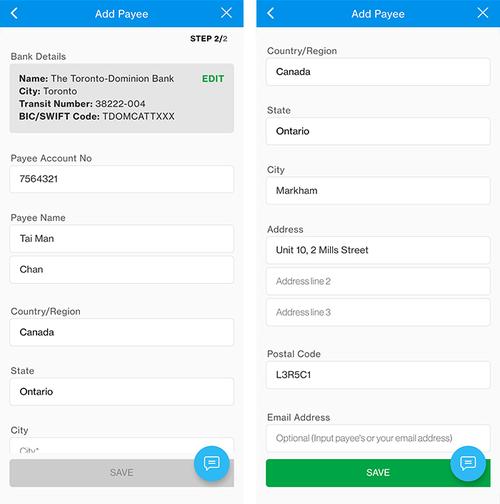

Bank Transfers: A Cost-Effective Alternative

For those who prefer not to use credit/debit cards or digital wallets, bank transfers can be a cost-effective way to buy USDT. Many exchanges in India offer this payment method, and the fees are generally lower compared to credit/debit card transactions. Here’s how you can do it:

- Choose an exchange that supports bank transfers.

- Register and verify your account.

- Deposit INR into your exchange wallet.

- Convert your INR to USDT.

Some exchanges may charge a small fee for bank transfers, but it’s usually lower than the fees for credit/debit card transactions. This method is particularly useful if you have a bank account and prefer not to use digital wallets.

ATM and P2P Platforms: Quick and Easy

ATMs and P2P platforms are two other options for buying USDT in India. These methods are quick and easy, but they may not always be the cheapest.

ATMs

ATMs that accept cryptocurrency purchases are becoming increasingly common in India. To buy USDT using an ATM, follow these steps:

- Find a USDT ATM near you.

- Insert your cash and select USDT as the payment option.

- Receive your USDT in your digital wallet.

ATMs typically charge a higher fee than exchanges or bank transfers, so they may not be the cheapest option. However, they offer a convenient way to buy USDT without the need for an exchange account.

P2P Platforms

P2P platforms connect buyers and sellers directly, allowing you to buy USDT from individuals. These platforms can be cheaper than exchanges, but they also come with higher risks. Here’s how to buy USDT using a P2P platform:

- Register and verify your account on a P2P platform.

- Find a seller offering USDT at a good price.

- Agree on the terms of the transaction.

- Make the payment to the seller.

- Receive your USDT in your digital wallet.

P2P platforms can be cheaper than exchanges, but they require more caution and due diligence. Always ensure that you’re dealing with a reputable seller and use secure payment methods.

Mobile Wallets: A Convenient Option

Mobile wallets are another convenient way to buy USDT in India. These wallets are often integrated with exchanges and allow you to buy USDT directly using your mobile phone. Some popular mobile wallets in India include:

- PhonePe

- Google Pay

- Paytm