Are you intrigued by the world of cryptocurrencies and looking to explore the possibilities of trading Bitcoin (BTC) and Tether (USDT)? If so, you’ve come to the right place. In this comprehensive guide, we’ll delve into the intricacies of BTC/USDT trading, covering everything from the basics to advanced strategies. Whether you’re a beginner or an experienced trader, this article will equip you with the knowledge you need to navigate the BTC/USDT market successfully.

Understanding BTC/USDT Trading

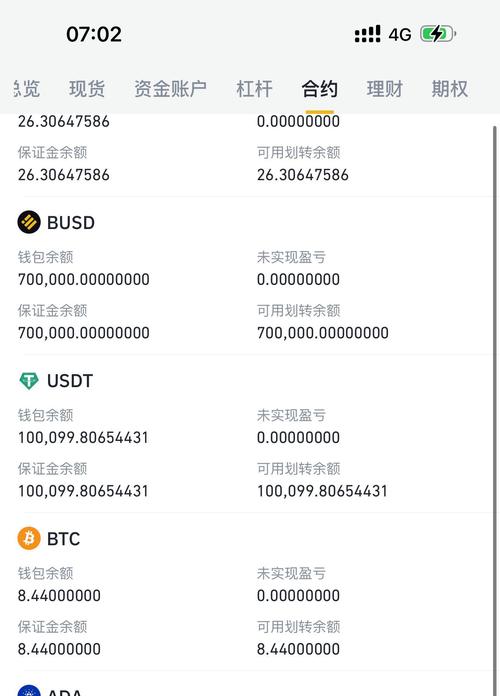

Before diving into the specifics of BTC/USDT trading, it’s essential to understand what it entails. BTC/USDT refers to the trading pair of Bitcoin and Tether, a stablecoin that is often used as a medium of exchange in the cryptocurrency market. This pairing allows traders to exchange Bitcoin for Tether or vice versa, providing a stable and secure way to manage their cryptocurrency portfolios.

How BTC/USDT Trading Works

Trading BTC/USDT is relatively straightforward. Here’s a step-by-step guide to help you get started:

| Step | Description |

|---|---|

| 1 | Choose a cryptocurrency exchange that supports BTC/USDT trading. |

| 2 | Open an account on the chosen exchange and complete the necessary verification process. |

| 3 | Deposit Bitcoin or Tether into your exchange account. |

| 4 | Place a buy or sell order for BTC/USDT. |

| 5 | Monitor your trades and adjust your strategy as needed. |

Benefits of Trading BTC/USDT

Trading BTC/USDT offers several advantages, including:

-

Stability: Tether is a stablecoin, which means its value is pegged to the US dollar. This provides a sense of stability in the volatile cryptocurrency market.

-

Accessibility: BTC/USDT trading pairs are widely available on most exchanges, making it easy for traders to access this market.

-

Low transaction fees: Trading BTC/USDT often comes with lower transaction fees compared to trading other cryptocurrency pairs.

-

High liquidity: BTC/USDT is one of the most traded pairs in the cryptocurrency market, ensuring that you can easily enter and exit positions.

Strategies for Trading BTC/USDT

When trading BTC/USDT, it’s crucial to have a well-defined strategy. Here are some popular trading strategies to consider:

-

Day Trading: This involves buying and selling BTC/USDT within the same day to capitalize on short-term price movements.

-

Swing Trading: Swing traders hold positions for a few days to a few weeks, aiming to profit from medium-term price trends.

-

Position Trading: Position traders hold positions for an extended period, often months or even years, to benefit from long-term price movements.

Risks and Considerations

While trading BTC/USDT offers numerous benefits, it’s important to be aware of the risks involved:

-

Market Volatility: The cryptocurrency market is known for its volatility, which can lead to significant gains or losses.

-

Liquidity Risk: Trading BTC/USDT on exchanges with low liquidity can make it challenging to enter or exit positions at desired prices.

-

Security Concerns: As with all cryptocurrency trading, it’s crucial to keep your assets secure by using reputable exchanges and wallets.

Conclusion

Trading BTC/USDT can be a lucrative venture, but it requires knowledge, discipline, and a well-defined strategy. By understanding the basics of BTC/USDT trading, familiarizing yourself with various trading strategies, and being aware of the risks involved, you’ll be well on your way to navigating the BTC/USDT market successfully.