Difference Between Usdt and Usdt

When it comes to the world of cryptocurrencies, understanding the nuances between different tokens is crucial. One such pair that often confuses many is Usdt and Usdt. While they may seem identical at first glance, there are several key differences that set them apart. Let’s delve into a detailed comparison to shed light on these distinctions.

What is Usdt?

Usdt, also known as Tether, is a cryptocurrency that aims to bridge the gap between traditional fiat currencies and digital assets. It is backed by a reserve of fiat currencies, primarily the US dollar. The primary goal of Usdt is to maintain a stable value, making it an attractive option for those looking to avoid the volatility associated with other cryptocurrencies.

What is Usdt?

Just like Usdt, Usdt is also a cryptocurrency that operates on the same principle of stability. It is designed to be a reliable store of value and is backed by a reserve of fiat currencies. However, there are some notable differences between the two that we will explore further.

Underlying Technology

One of the key differences between Usdt and Usdt lies in their underlying technology. Usdt operates on the Omni Layer protocol, which is built on top of the Bitcoin blockchain. This means that Usdt is a “colored coin,” meaning it is a token that is created and managed within the Bitcoin network. On the other hand, Usdt is built on the Ethereum blockchain, utilizing its smart contract capabilities.

Market Capitalization

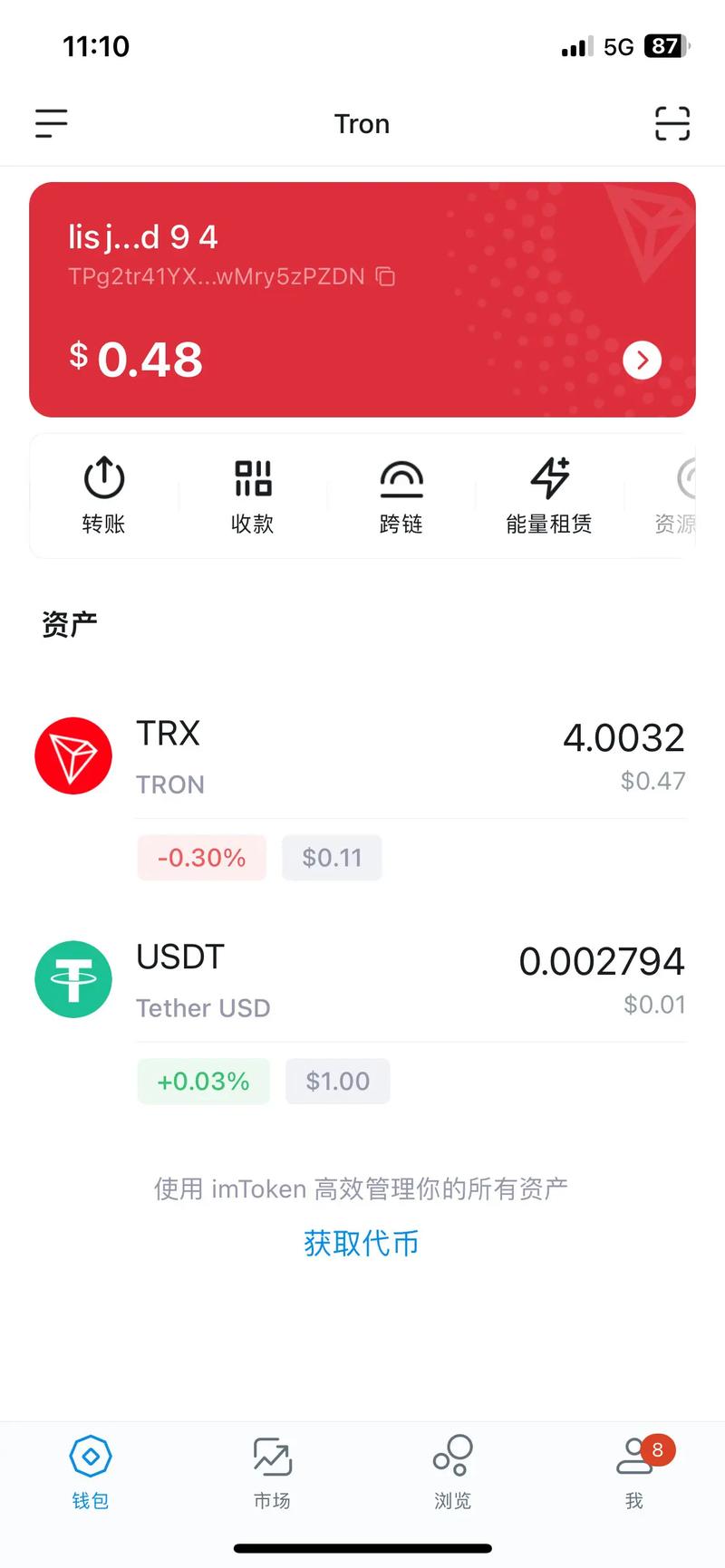

When it comes to market capitalization, Usdt holds a significant advantage over Usdt. As one of the most popular stablecoins, Usdt has a market capitalization of over $80 billion, making it the largest stablecoin by far. Usdt, while still a notable player in the stablecoin space, has a much smaller market capitalization compared to Usdt.

Transaction Speed

Another important factor to consider is the transaction speed. Usdt, being built on the Bitcoin blockchain, tends to have slower transaction times compared to Usdt. This is due to the limitations of the Bitcoin network. On the other hand, Usdt leverages the Ethereum network, which offers faster transaction speeds and lower fees. This makes Usdt a more efficient choice for those who require quick and cost-effective transactions.

Regulatory Compliance

Regulatory compliance is a crucial aspect to consider when dealing with cryptocurrencies. Usdt has faced some regulatory challenges in the past, with concerns regarding its reserve backing and transparency. While Usdt has made efforts to address these concerns, it is still a subject of debate among regulators and investors. On the other hand, Usdt has been more transparent in its operations and has received positive feedback from regulatory authorities.

Use Cases

Usdt and Usdt have different use cases within the cryptocurrency ecosystem. Usdt is often used as a medium of exchange, allowing users to trade other cryptocurrencies or fiat currencies without the fear of volatility. It is also widely used in decentralized finance (DeFi) applications. Usdt, on the other hand, is primarily used as a store of value and a means to hedge against market fluctuations.

Conclusion

In conclusion, while Usdt and Usdt may share the same name, they are distinct cryptocurrencies with their own unique characteristics. Usdt, with its backing of fiat currencies and underlying technology, offers stability and reliability. On the other hand, Usdt, built on the Ethereum blockchain, provides faster transaction speeds and a more efficient user experience. Understanding these differences is crucial for anyone looking to navigate the world of stablecoins and make informed decisions.

| Comparison | Usdt | Usdt |

|---|---|---|

| Underlying Technology | Omni Layer protocol (Bitcoin blockchain) | Ethereum blockchain |

| Market Capitalization | Over $80 billion | Significantly smaller |

| Transaction Speed | Slower | Faster |

| Regulatory Compliance | Some concerns | Positive feedback from regulatory authorities |

| Use

|