Did Usdt Crash?

Have you been wondering if USDT, the popular stablecoin, experienced a crash recently? Well, you’ve come to the right place. In this detailed analysis, we will delve into the factors that might have contributed to any potential crash and the impact it had on the market. Let’s explore the situation from various angles.

Understanding USDT

Before we dive into the crash, let’s first understand what USDT is. Tether (USDT) is a cryptocurrency that aims to maintain a stable value by backing each USDT token with one US dollar. It is one of the most widely used stablecoins in the cryptocurrency market.

The Potential Crash

Reports of a potential crash in USDT have been circulating recently. To determine if it actually happened, we need to look at the factors that could have led to such a situation.

Market Volatility

One of the primary reasons for the potential crash could be the increased market volatility. The cryptocurrency market has been known for its unpredictable nature, and recent events have caused a significant amount of uncertainty. This uncertainty might have led to a sell-off of USDT, causing its value to drop temporarily.

Regulatory Concerns

Another factor that could have contributed to the potential crash is regulatory concerns. Governments around the world have been closely monitoring the cryptocurrency market, and any regulatory news can have a significant impact on the market sentiment. If there were any rumors or news about potential regulatory actions against Tether, it could have caused panic and a subsequent crash.

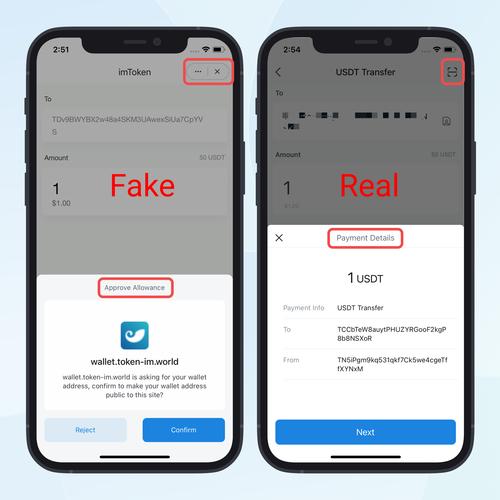

Technical Issues

Technical issues within the Tether platform could also be a reason for the potential crash. If there were any disruptions in the system or delays in processing transactions, it could have led to a loss of trust in the stablecoin, causing investors to sell off their holdings.

Impact on the Market

Now that we have explored the potential reasons for the crash, let’s look at the impact it had on the market.

Market Sentiment

The potential crash in USDT might have had a negative impact on market sentiment. Investors might have become more cautious and hesitant to invest in cryptocurrencies, leading to a decrease in overall market activity.

Other Cryptocurrencies

The crash in USDT might have also affected other cryptocurrencies. Investors might have taken this opportunity to sell off their holdings in other altcoins, causing a ripple effect throughout the market.

Conclusion

In conclusion, while there were reports of a potential crash in USDT, it is essential to consider the various factors that could have contributed to such a situation. Market volatility, regulatory concerns, and technical issues are some of the key factors that might have played a role. The impact on the market was evident, with a negative sentiment and a decrease in overall market activity. However, it is crucial to remember that the cryptocurrency market is highly unpredictable, and such events are not uncommon.

| Factor | Description |

|---|---|

| Market Volatility | Increased market uncertainty and volatility can lead to sell-offs in stablecoins like USDT. |

| Regulatory Concerns | Rumors or news about potential regulatory actions can cause panic and a subsequent crash. |

| Technical Issues | Disruptions or delays in the Tether platform can lead to a loss of trust and a crash. |