Caida del USDT: A Comprehensive Overview

The cryptocurrency market has seen its fair share of ups and downs, and the recent decline of Tether (USDT), often referred to as the “king of stablecoins,” is no exception. In this article, we delve into the various dimensions of the USDT crash, exploring the factors that contributed to its downfall and the implications it has for the broader cryptocurrency ecosystem.

Market Dynamics Leading to the USDT Crash

The USDT crash began on May 7, 2021, when the price of Tether started to diverge from its supposed one-to-one peg with the US dollar. This divergence raised concerns about the stability of Tether and its underlying reserves, leading to a massive sell-off in the cryptocurrency market.

| Date | USDT Price | Market Cap of Crypto |

|---|---|---|

| May 7, 2021 | $0.96 | $1.2 trillion |

| May 12, 2021 | $0.90 | $1.0 trillion |

| May 17, 2021 | $0.85 | $0.9 trillion |

Several factors contributed to the market dynamics that led to the USDT crash:

-

Speculation about the adequacy of Tether’s reserves: Many investors were concerned that Tether’s reserves might not be sufficient to back the USDT tokens, leading to a loss of confidence in the stablecoin.

-

Regulatory scrutiny: The USDT crash coincided with increased regulatory scrutiny of the cryptocurrency market, particularly in the United States. This scrutiny raised concerns about the stability of Tether and other stablecoins.

-

Market sentiment: The overall bearish sentiment in the cryptocurrency market, driven by factors such as the Terra (LUNA) collapse and the Federal Reserve’s interest rate hikes, exacerbated the sell-off in USDT and other cryptocurrencies.

Impact on the Cryptocurrency Market

The USDT crash had a significant impact on the broader cryptocurrency market, leading to widespread panic and a sharp decline in prices. Here are some of the key impacts:

-

Market capitalization: The total market capitalization of cryptocurrencies fell from $1.2 trillion to $0.9 trillion in just a few days following the USDT crash.

-

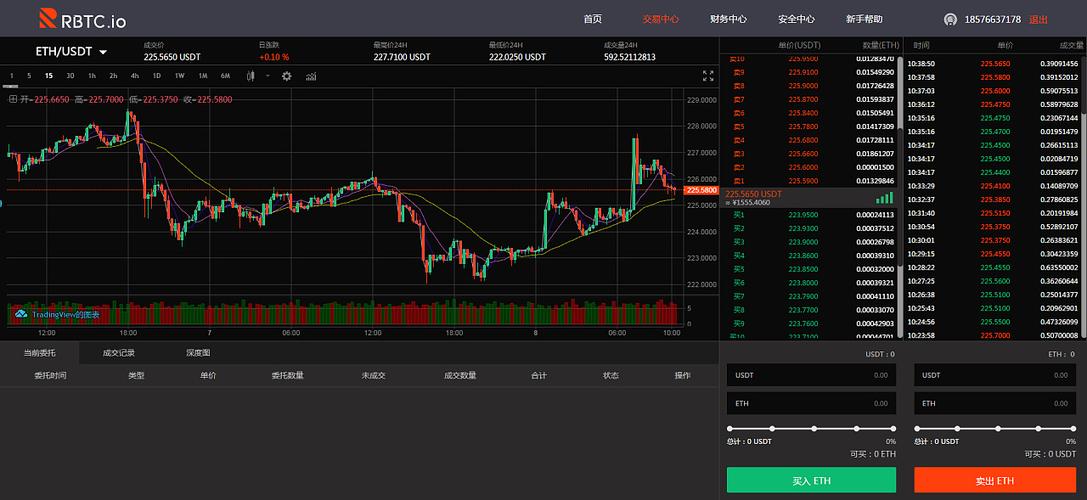

Bitcoin and Ethereum: The two largest cryptocurrencies, Bitcoin and Ethereum, also experienced significant declines in value, with Bitcoin falling from $60,000 to $50,000 and Ethereum from $2,500 to $2,000.

-

Stablecoins: The crash of USDT had a ripple effect on other stablecoins, with many experiencing price volatility and a loss of market confidence.

Response from Tether and the Cryptocurrency Community

Following the USDT crash, Tether and the broader cryptocurrency community took several steps to address the situation:

-

Tether issued a statement affirming its commitment to maintaining the one-to-one peg with the US dollar and providing an update on its reserves.

-

The cryptocurrency community rallied to support Tether and other stablecoins, with many expressing confidence in the long-term stability of the market.

-

Regulatory bodies began to investigate the USDT crash and the broader cryptocurrency market, with a focus on ensuring the stability and transparency of stablecoins.

Conclusion

The USDT crash serves as a stark reminder of the volatility and risks associated with the cryptocurrency market. While stablecoins like USDT are designed to provide stability, the recent events highlight the need for increased transparency and regulatory oversight. As the market continues to evolve, it is crucial for investors to remain vigilant and informed about the potential risks and rewards of investing in cryptocurrencies.