Crypto Different Markets: BTC, ETH, BNB, USDT

When diving into the world of cryptocurrencies, it’s essential to understand the different markets and their unique characteristics. In this article, we will explore the four most prominent markets: Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Tether (USDT). By delving into their histories, market dynamics, and potential future developments, we aim to provide you with a comprehensive overview of each market.

Bitcoin (BTC)

Bitcoin, often referred to as the “gold of cryptocurrencies,” was launched in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. It was the first decentralized digital currency, aiming to eliminate the need for a central authority like a bank or government.

Bitcoin operates on a blockchain, a public ledger that records all transactions across a network of computers. Its supply is capped at 21 million coins, making it a deflationary asset. Bitcoin has seen significant growth since its inception, with its value skyrocketing from a few cents to thousands of dollars per coin.

Market Dynamics: Bitcoin has been the leading cryptocurrency in terms of market capitalization. Its price is influenced by various factors, including investor sentiment, regulatory news, and macroeconomic trends. Bitcoin’s correlation with traditional financial markets has also been a topic of interest, with some analysts suggesting it acts as a hedge against inflation and economic uncertainty.

Ethereum (ETH)

Ethereum, launched in 2015 by Vitalik Buterin, is the second-largest cryptocurrency by market capitalization. It aims to create a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). Unlike Bitcoin, Ethereum’s blockchain is programmable, allowing developers to build complex applications on top of it.

Ethereum’s native token, ETH, is used to pay for transaction fees and as a medium of exchange within the network. The Ethereum network has undergone significant upgrades, including the transition from Proof of Work (PoW) to Proof of Stake (PoS) with Ethereum 2.0, aiming to improve scalability and energy efficiency.

Market Dynamics: Ethereum’s price is influenced by factors such as the demand for DApps, the success of its ecosystem, and regulatory news. The Ethereum network has faced challenges, including high gas fees and scalability issues, which have impacted its performance. However, the ongoing upgrades and the growing ecosystem have provided optimism for its future.

Binance Coin (BNB)

Binance Coin, launched in 2017 by the Binance exchange, is the third-largest cryptocurrency by market capitalization. It serves as the native token of the Binance ecosystem, offering various benefits to users, including discounted trading fees, access to exclusive services, and participation in governance.

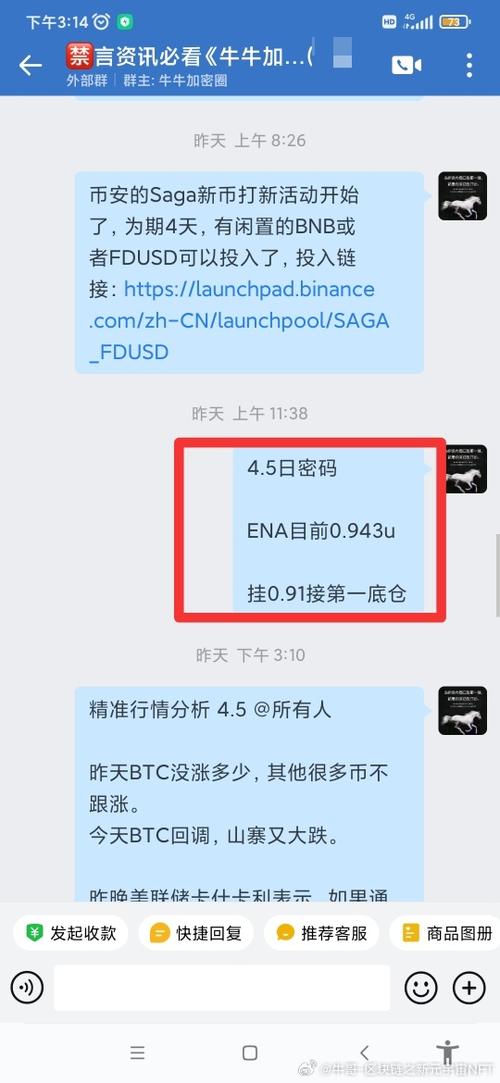

Binance Coin can be used for a wide range of purposes, including paying for transaction fees on the Binance Smart Chain, purchasing goods and services, and participating in the Binance Launchpad, a platform for launching new tokens and projects.

Market Dynamics: Binance Coin’s price is influenced by the success of the Binance exchange, the growth of the Binance Smart Chain, and the overall demand for the token. The token has seen significant growth, driven by its utility within the Binance ecosystem and the expansion of its use cases.

Tether (USDT)

Tether, launched in 2014, is a stablecoin designed to provide a stable value by pegging it to the US dollar. It aims to offer a bridge between the traditional financial system and the cryptocurrency world. Tether is backed by fiat currency reserves, which are held in various financial institutions.

USDT is widely used for trading, liquidity, and as a medium of exchange. It has gained popularity due to its stability, making it a preferred choice for traders looking to mitigate the volatility of cryptocurrencies.

Market Dynamics: Tether’s price is closely tied to the value of the US dollar. Its stability makes it a popular choice for traders and investors looking to park their capital in a low-risk asset. However, concerns regarding the transparency of its reserves and the potential for manipulation have raised questions about its long-term viability.

In conclusion, understanding the different markets of cryptocurrencies, such as Bitcoin, Ethereum, Binance Coin, and Tether, is crucial for anyone looking to invest or trade in this rapidly evolving space. Each market has its unique characteristics, market dynamics, and potential future developments. By staying informed and educated, you can make more informed decisions and navigate the crypto markets with confidence.

| Cryptocurrency |

|---|