BTC/USD vs BTC/USDT: A Comprehensive Guide

When it comes to trading Bitcoin, one of the most common questions that arise is whether to trade BTC/USD or BTC/USDT. Both pairs offer unique advantages and considerations, making it essential to understand their differences. In this article, we will delve into the details of BTC/USD and BTC/USDT, comparing their features, liquidity, fees, and more.

Understanding BTC/USD

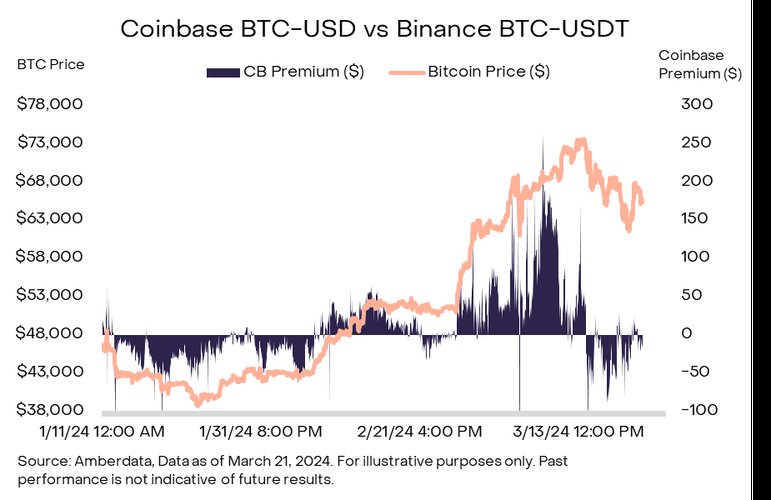

BTC/USD is a cryptocurrency trading pair that represents the value of one Bitcoin in terms of US Dollars. This pair is often considered the gold standard in the cryptocurrency market, as it is directly tied to the fiat currency, making it easier for traders to understand and compare the value of Bitcoin against traditional currencies.

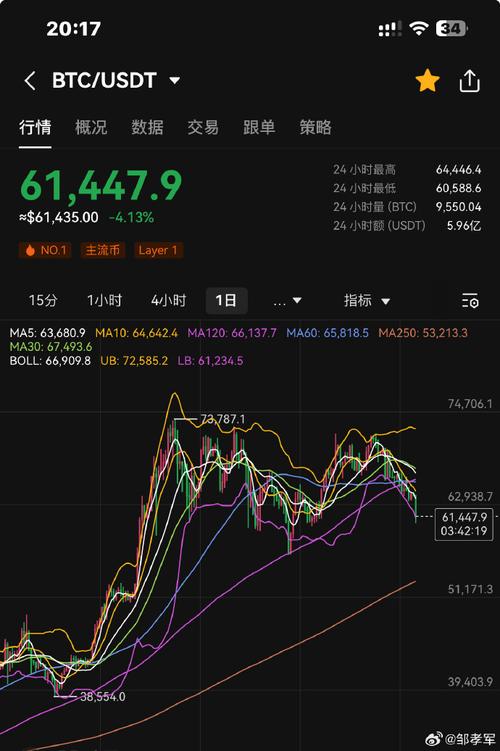

Understanding BTC/USDT

BTC/USDT, on the other hand, is a cryptocurrency trading pair that represents the value of one Bitcoin in terms of Tether (USDT), a stablecoin. Tether is designed to maintain a stable value of $1 USD, making BTC/USDT a popular choice for traders looking to avoid the volatility associated with fiat currencies.

Liquidity

Liquidity is a crucial factor to consider when trading cryptocurrencies. BTC/USD typically offers higher liquidity compared to BTC/USDT, as it is directly tied to the US Dollar, which is the world’s most traded currency. This means that there is a larger pool of buyers and sellers, making it easier to execute trades at competitive prices.

In contrast, BTC/USDT may have lower liquidity, as it is tied to a stablecoin. However, the liquidity of BTC/USDT has been improving over time, as more traders and investors recognize the benefits of using stablecoins for trading.

Fees

Fees are another important aspect to consider when trading cryptocurrencies. Generally, BTC/USD trading pairs tend to have lower fees compared to BTC/USDT. This is because the trading volume for BTC/USD is higher, and exchanges can offer competitive fees to attract traders.

However, it’s important to note that fees can vary significantly between exchanges, so it’s essential to compare the fees for both BTC/USD and BTC/USDT on different platforms to find the most cost-effective option.

Volatility

Volatility is a measure of how much the price of a cryptocurrency fluctuates over a given period. BTC/USD is generally more volatile compared to BTC/USDT, as it is directly tied to the US Dollar, which can experience significant price movements due to economic and political events.

BTC/USDT, being tied to a stablecoin, offers a more stable trading experience. This can be beneficial for traders looking to avoid the risks associated with high volatility, such as sudden price spikes or drops.

Regulatory Considerations

Regulatory considerations play a significant role in the cryptocurrency market. BTC/USD is subject to the regulations of the country in which the exchange is based, as well as the regulations of the United States, where the US Dollar is the official currency.

BTC/USDT, being a stablecoin, may be subject to different regulations, depending on the country in which the exchange is based. It’s important to research the regulatory landscape of the exchange you choose to trade on, as this can impact your ability to trade and withdraw funds.

Conclusion

When deciding between BTC/USD and BTC/USDT, it’s essential to consider your trading goals, risk tolerance, and the specific features of each trading pair. BTC/USD offers higher liquidity and volatility, while BTC/USDT provides stability and lower volatility. Ultimately, the best choice depends on your individual preferences and needs.

| Feature | BTC/USD | BTC/USDT |

|---|---|---|

| Liquidity | High | Medium |

| Fees | Low | Medium |

| Volatility | High | Low |

| Regulatory Considerations | Varies by country | Varies by country |