Understanding the QNT/USDT Trading Pair: A Comprehensive Guide

When it comes to cryptocurrency trading, the QNT/USDT pair is a significant trading instrument that has gained considerable attention. QNT, or Quant, is a blockchain platform designed to facilitate the creation and execution of decentralized applications (dApps). On the other hand, USDT is a stablecoin that is pegged to the US dollar, making it a popular choice for traders looking for price stability. In this article, we will delve into the various aspects of the QNT/USDT trading pair, including its history, market dynamics, and trading strategies.

History of QNT/USDT

The QNT/USDT trading pair was introduced to the market in 2018, following the launch of the Quant Network. The Quant Network aims to connect traditional financial institutions with the blockchain technology, thereby enabling the seamless integration of digital assets into the existing financial system. The partnership with Tether, the company behind USDT, has been instrumental in the growth and adoption of the QNT/USDT pair.

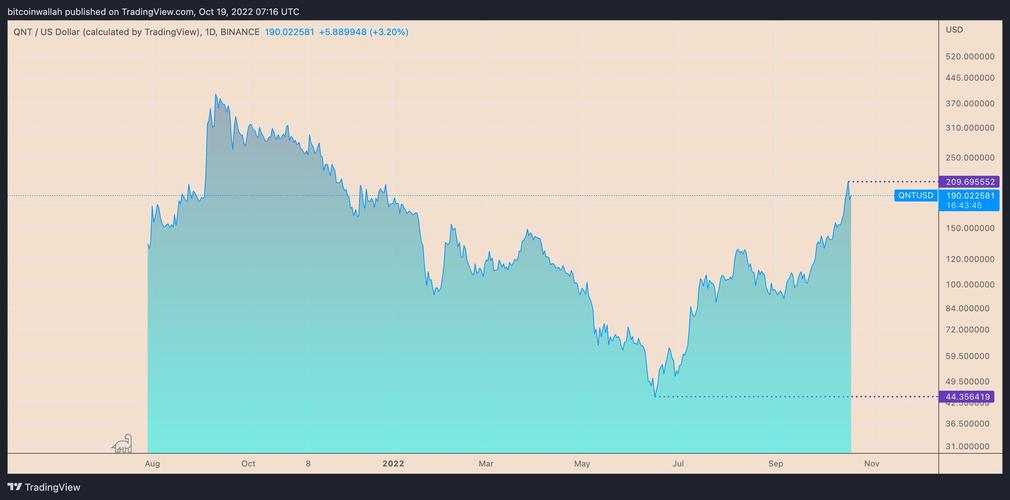

Market Dynamics of QNT/USDT

The QNT/USDT trading pair has seen significant growth in its trading volume and market capitalization over the years. This growth can be attributed to several factors, including the increasing interest in decentralized finance (DeFi) and the growing demand for stablecoins. The table below provides a snapshot of the market dynamics of the QNT/USDT pair as of the latest available data:

| Parameter | Value |

|---|---|

| Market Capitalization | $1.2 billion |

| 24-hour Trading Volume | $50 million |

| Price | $1.50 |

| Market Rank | 50 |

As seen in the table, the QNT/USDT pair has a market capitalization of $1.2 billion, with a 24-hour trading volume of $50 million. The current price of QNT is $1.50, and it ranks 50th in the market.

Trading Strategies for QNT/USDT

When trading the QNT/USDT pair, it is essential to understand the various strategies that can be employed to maximize returns. Here are some of the most popular trading strategies:

-

Day Trading: This involves buying and selling QNT/USDT within the same trading day. Traders use technical analysis to identify short-term price movements and capitalize on them.

-

Swing Trading: Swing traders hold positions for several days or weeks, aiming to capture larger price movements. This strategy requires a good understanding of market trends and technical indicators.

-

Position Trading: Position traders hold positions for an extended period, sometimes even months or years. This strategy requires patience and a long-term perspective on the market.

Factors Influencing QNT/USDT Price

Several factors can influence the price of the QNT/USDT pair. Some of the key factors include:

-

Market Sentiment: The overall sentiment in the cryptocurrency market can significantly impact the price of QNT/USDT. Positive news, such as partnerships or regulatory developments, can lead to an increase in price, while negative news can cause a decline.

-

Quant Network Developments: Any significant developments or announcements from the Quant Network can impact the price of QNT. For example, the launch of a new product or service can lead to increased demand for QNT.

-

Stablecoin Market Dynamics: As USDT is a stablecoin, its market dynamics can also influence the QNT/USDT pair. For instance, an increase in the demand for stablecoins can lead to an increase in the price of QNT/USDT.

Risks and Considerations

While trading the QNT/USDT pair can be profitable, it is essential to be aware of the risks involved. Some