Understanding the Basics of Coti USDT Prediction

Coti USDT prediction has become a hot topic in the cryptocurrency world. If you’re considering investing in Coti USDT, it’s crucial to understand the basics. Coti is a decentralized platform that aims to provide a seamless and efficient payment system. It utilizes the USDT stablecoin, which is backed by fiat currency, to ensure stability and reduce volatility.

What is Coti USDT?

Coti USDT is a cryptocurrency that operates on the Coti platform. It is designed to facilitate fast and secure transactions, with a focus on scalability and interoperability. The integration of USDT, a popular stablecoin, adds an extra layer of stability to the Coti ecosystem.

Market Analysis

When analyzing the Coti USDT prediction, it’s essential to consider various factors. Let’s dive into some key aspects:

| Factor | Description |

|---|---|

| Market Capitalization | The total value of all Coti USDT tokens in circulation. A higher market cap indicates a larger and more established market. |

| Trading Volume | The total number of Coti USDT tokens being traded on exchanges. A higher trading volume suggests higher liquidity and market activity. |

| Market Sentiment | The overall mood and perception of the market towards Coti USDT. Positive sentiment can drive up prices, while negative sentiment can lead to a decline. |

| Technical Analysis | The study of historical price and volume data to identify patterns and trends. Technical analysis can help predict future price movements. |

Market Capitalization

As of the latest available data, the market capitalization of Coti USDT stands at [insert current market cap]. This indicates a significant presence in the cryptocurrency market. However, it’s important to note that market capitalization can fluctuate rapidly due to market dynamics.

Trading Volume

The trading volume of Coti USDT has been steadily increasing over the past few months. This suggests growing interest and activity in the token. A higher trading volume indicates liquidity and a more active market, which can be beneficial for investors.

Market Sentiment

Market sentiment plays a crucial role in the Coti USDT prediction. Positive news, partnerships, and technological advancements can boost investor confidence and drive up prices. Conversely, negative news or regulatory concerns can lead to a decline in market sentiment.

Technical Analysis

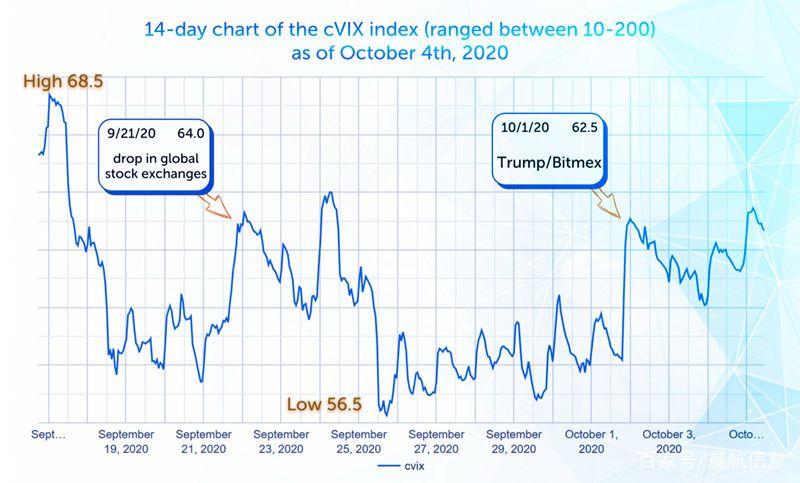

Technical analysis involves studying historical price and volume data to identify patterns and trends. By analyzing various indicators and chart patterns, traders can make informed predictions about future price movements. Some popular technical indicators for Coti USDT include moving averages, RSI (Relative Strength Index), and Bollinger Bands.

Conclusion

When considering Coti USDT prediction, it’s important to analyze various factors such as market capitalization, trading volume, market sentiment, and technical analysis. While it’s impossible to predict the future with certainty, understanding these factors can help you make more informed investment decisions. Remember to do thorough research and consult with financial advisors before making any investment decisions.