Understanding BTC3L/USDT: A Comprehensive Guide

Are you curious about the BTC3L/USDT trading pair? This guide will delve into the intricacies of this cryptocurrency trading pair, providing you with a detailed understanding of its market dynamics, trading strategies, and potential risks.

What is BTC3L?

BTC3L, also known as Bitcoin 3L, is a cryptocurrency that aims to offer a faster and more secure transaction process compared to Bitcoin. It utilizes the same blockchain technology as Bitcoin but with some improvements. BTC3L is designed to address the limitations of Bitcoin, such as slower transaction speeds and higher transaction fees.

Understanding USDT

USDT, or Tether, is a stablecoin that is backed by fiat currencies, primarily the US dollar. It is designed to provide a stable value, making it an attractive option for traders and investors looking for a reliable store of value. USDT is often used as a medium of exchange in the cryptocurrency market.

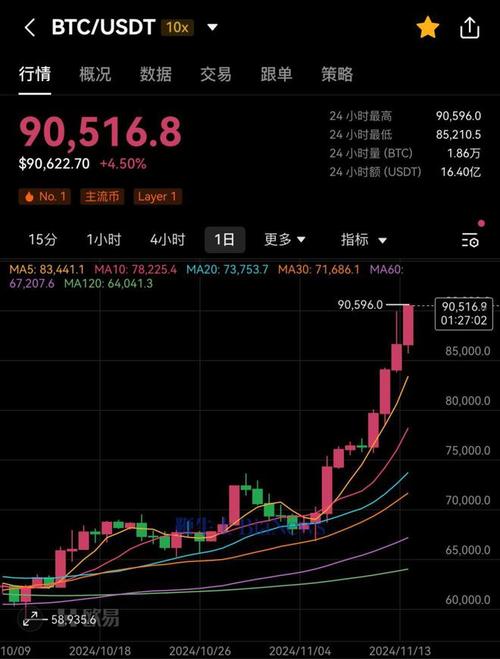

Market Dynamics of BTC3L/USDT

The BTC3L/USDT trading pair is a popular choice among cryptocurrency traders. Here are some key aspects of its market dynamics:

| Market Aspect | Description |

|---|---|

| Market Capitalization | The total value of all BTC3L tokens in circulation. |

| Trading Volume | The total number of BTC3L/USDT transactions in a given period. |

| Price Fluctuations | The changes in the BTC3L/USDT exchange rate over time. |

| Market Sentiment | The overall perception and sentiment of traders towards BTC3L/USDT. |

Trading Strategies for BTC3L/USDT

When trading BTC3L/USDT, it is essential to have a well-defined strategy. Here are some popular trading strategies:

-

Day Trading: This involves buying and selling BTC3L/USDT within the same trading day to capitalize on short-term price movements.

-

Swing Trading: This strategy focuses on identifying and capitalizing on medium-term price trends.

-

Long-Term Investing: This involves holding BTC3L/USDT for an extended period, often years, with the expectation of long-term growth.

Risks and Considerations

While trading BTC3L/USDT can be profitable, it is crucial to be aware of the associated risks:

-

Market Volatility: Cryptocurrency markets can be highly volatile, leading to significant price fluctuations.

-

Regulatory Risks: The regulatory landscape for cryptocurrencies is still evolving, which can impact the market.

-

Security Risks: As with any cryptocurrency, there is a risk of theft or loss due to security breaches.

Conclusion

Understanding the BTC3L/USDT trading pair requires a comprehensive understanding of its market dynamics, trading strategies, and potential risks. By familiarizing yourself with these aspects, you can make informed decisions and potentially achieve success in trading BTC3L/USDT.