Understanding BTC/USDT Investing

Investing in cryptocurrencies, particularly Bitcoin (BTC) and Tether (USDT), has become increasingly popular in recent years. As you consider adding BTC/USDT to your investment portfolio, it’s crucial to understand the nuances of this investment. This article will delve into the details, providing you with a comprehensive guide to BTC/USDT investing.

What is BTC/USDT?

Bitcoin (BTC) is a decentralized digital currency, created in 2009 by an unknown person or group using the name Satoshi Nakamoto. It operates on a peer-to-peer network and is not controlled by any central authority. Tether (USDT), on the other hand, is a stablecoin designed to maintain a stable value by being backed by fiat currencies, primarily the US dollar. BTC/USDT refers to the trading pair where Bitcoin is exchanged for Tether.

Understanding the Market

The cryptocurrency market is known for its volatility, and BTC/USDT is no exception. Before diving into investing, it’s essential to understand the factors that influence the market. These include:

| Factor | Description |

|---|---|

| Supply and Demand | The value of Bitcoin and Tether is influenced by the supply and demand dynamics in the market. |

| Market Sentiment | Investor emotions and perceptions can significantly impact the price of BTC/USDT. |

| Regulatory Changes | New regulations or changes in existing ones can affect the market. |

| Technological Developments | Innovations in blockchain technology can influence the value of BTC/USDT. |

Choosing a Platform

Selecting the right platform for trading BTC/USDT is crucial. Here are some factors to consider:

- Security: Ensure the platform has robust security measures to protect your investments.

- Reputation: Research the platform’s reputation and user reviews.

- Fee Structure: Understand the fees associated with trading and withdrawing funds.

- Customer Support: Look for platforms with reliable customer support.

Strategies for Investing in BTC/USDT

There are various strategies you can employ when investing in BTC/USDT:

- Day Trading: This involves buying and selling BTC/USDT within the same day to capitalize on short-term price fluctuations.

- Swing Trading: Swing traders hold positions for a few days to weeks, aiming to profit from medium-term price movements.

- Long-Term Holding: This strategy involves holding BTC/USDT for an extended period, often years, with the expectation that the value will increase over time.

Risks and Considerations

Investing in BTC/USDT carries risks, including:

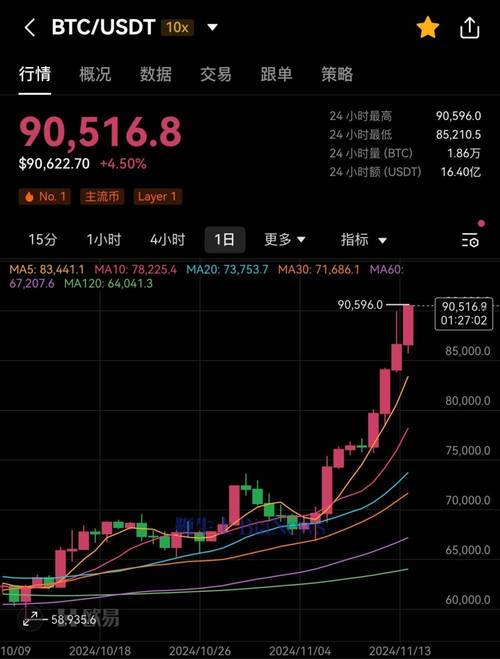

- Market Volatility: The price of BTC/USDT can be highly volatile, leading to significant gains or losses.

- Liquidity Risk: Some cryptocurrencies may have limited liquidity, making it challenging to buy or sell at desired prices.

- Regulatory Risk: Changes in regulations can impact the value of BTC/USDT and the overall cryptocurrency market.

Monitoring Your Investments

Keeping an eye on your investments is crucial. Here are some tips:

- Stay Informed: Keep up-to-date with market news and developments.

- Set Alerts: Use price alerts to notify you when BTC/USDT reaches a specific price.

- Review Your Portfolio: Regularly assess the performance of your investments and adjust your strategy as needed.

Conclusion

Investing in BTC/USDT can be a lucrative venture, but it requires thorough research and understanding of the market. By considering the factors mentioned in this article, you can make informed decisions and potentially achieve success in your BTC/USDT investments.