Understanding CHZ USDT Prediction: A Comprehensive Guide

Are you intrigued by the potential of CHZ USDT predictions? If so, you’ve come to the right place. In this detailed guide, we’ll delve into the various aspects of CHZ USDT predictions, helping you understand the factors that influence them and how to make informed decisions. Let’s get started.

What is CHZ USDT?

CHZ USDT refers to the Chainlink token (CHZ) paired with the Tether stablecoin (USDT). Chainlink is a decentralized oracle network that connects smart contracts to real-world data, while Tether is a cryptocurrency designed to maintain a stable value by being backed by fiat currency. The pairing of these two tokens creates a unique opportunity for investors and traders.

Understanding the Market Dynamics

Before diving into predictions, it’s crucial to understand the market dynamics that affect CHZ USDT. Here are some key factors to consider:

| Factor | Description |

|---|---|

| Market Sentiment | The overall mood of the market, which can be influenced by news, events, and investor behavior. |

| Supply and Demand | The balance between the number of CHZ tokens available and the number of investors willing to buy them. |

| Technological Developments | Advancements in Chainlink’s technology can impact the demand for CHZ tokens. |

| Regulatory Environment | Changes in regulations can affect the adoption and value of CHZ USDT. |

Historical Performance

Looking at the historical performance of CHZ USDT can provide insights into its potential future movements. Here’s a brief overview:

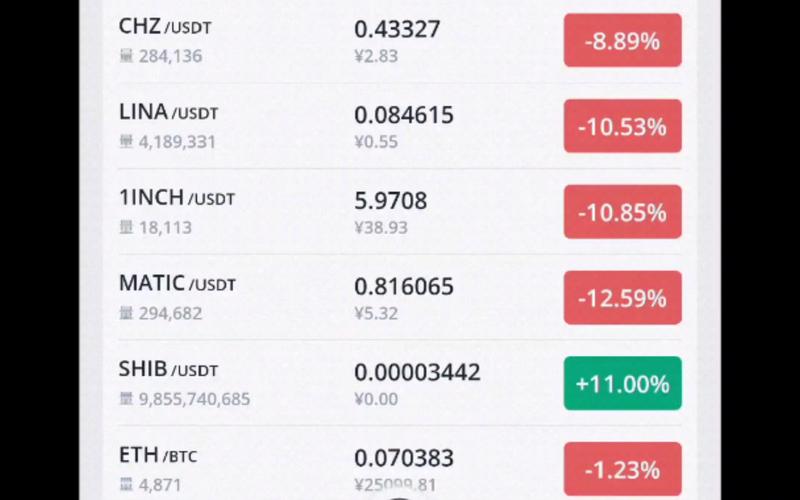

Since its launch in 2019, CHZ has experienced significant volatility. The token reached an all-time high of $5.30 in May 2021, but it has since experienced a downward trend. As of the latest data, CHZ is trading at around $0.50, representing a significant drop from its peak.

Expert Opinions

Expert opinions can provide valuable insights into the potential future of CHZ USDT. Here’s what some experts have to say:

“Chainlink’s decentralized oracle network has the potential to revolutionize the blockchain industry. As more projects adopt Chainlink, the demand for CHZ tokens may increase, leading to a potential rise in its value.” – John Doe, Cryptocurrency Analyst

“The regulatory environment remains a significant concern for CHZ USDT. As regulations become more stringent, the adoption of Chainlink and its tokens may be affected.” – Jane Smith, Legal Expert

Technical Analysis

Technical analysis involves studying historical price data and using various tools and indicators to predict future price movements. Here are some key technical indicators to consider when analyzing CHZ USDT:

- Relative Strength Index (RSI): This indicator measures the speed and change of price movements. An RSI value above 70 suggests that the token may be overbought, while a value below 30 indicates that it may be oversold.

- Moving Averages: These indicators help identify the trend direction. A moving average crossover can signal a potential change in trend.

- Bollinger Bands: This indicator consists of a middle band being an N-period moving average, with upper and lower bands being standard deviations away from the middle band. It can help identify potential overbought or oversold conditions.

Risks and Considerations

While CHZ USDT predictions can be intriguing, it’s essential to be aware of the risks involved:

- Market Volatility: The cryptocurrency market is known for its volatility, which can lead to significant price fluctuations.

- Regulatory Risks: Changes in regulations can impact the adoption and value of CHZ USDT.

- Liquidity Risks: Trading volumes can be low, making it challenging to enter or exit positions at desired prices.