Difference Between Inverse Perpetual and USDT Perpetual

When it comes to trading cryptocurrencies, perpetual contracts have become increasingly popular. These contracts allow traders to speculate on the price of an asset without the need to own the actual asset. Two types of perpetual contracts that often confuse traders are inverse perpetual and USDT perpetual. In this article, we will delve into the differences between these two contract types, providing you with a comprehensive understanding of their unique features and how they can impact your trading strategy.

Understanding Inverse Perpetual Contracts

Inverse perpetual contracts are designed to trade the inverse of the underlying asset. This means that when the price of the underlying asset increases, the price of the inverse contract decreases, and vice versa. These contracts are particularly useful for traders who believe that the price of the underlying asset will decline.

Here’s how inverse perpetual contracts work:

| Underlying Asset Price | Inverse Perpetual Contract Price |

|---|---|

| Increasing | Decreasing |

| Decreasing | Increasing |

One of the key advantages of inverse perpetual contracts is that they provide traders with the ability to profit from falling markets. This can be particularly beneficial during bearish market conditions when traditional long positions may not be as profitable.

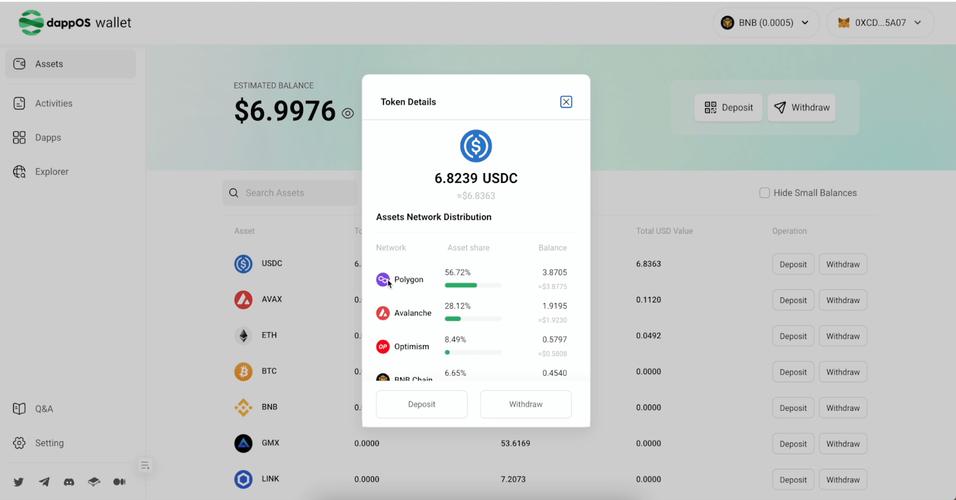

Understanding USDT Perpetual Contracts

USDT perpetual contracts, on the other hand, are based on the Tether (USDT) stablecoin. Tether is designed to maintain a 1:1 peg to the US dollar, making it a popular choice for traders looking to mitigate the volatility associated with traditional cryptocurrencies. USDT perpetual contracts allow traders to speculate on the price of the underlying asset without the need to worry about the price of USDT itself.

Here’s how USDT perpetual contracts work:

| Underlying Asset Price | USDT Perpetual Contract Price |

|---|---|

| Increasing | Increasing |

| Decreasing | Decreasing |

One of the primary benefits of USDT perpetual contracts is that they provide traders with a stable and predictable trading environment. Since USDT is pegged to the US dollar, the price of the contract will closely follow the price of the underlying asset, without the added volatility of the cryptocurrency market.

Key Differences Between Inverse Perpetual and USDT Perpetual Contracts

Now that we have a basic understanding of both inverse perpetual and USDT perpetual contracts, let’s explore the key differences between the two:

- Asset Type: Inverse perpetual contracts trade the inverse of the underlying asset, while USDT perpetual contracts are based on the Tether stablecoin.

- Volatility: Inverse perpetual contracts can be more volatile than USDT perpetual contracts, as they are directly tied to the price movements of the underlying asset. USDT perpetual contracts, being based on a stablecoin, offer a more stable and predictable trading environment.

- Trading Strategy: Inverse perpetual contracts are best suited for traders who believe the price of the underlying asset will decline, while USDT perpetual contracts can be used by traders looking to speculate on the price of the underlying asset without worrying about the volatility of the cryptocurrency market.

Conclusion

Understanding the differences between inverse perpetual and USDT perpetual contracts is crucial for traders looking to navigate the complex world of cryptocurrency trading. By choosing the right contract type based on your trading strategy and risk tolerance, you can maximize your chances of success in the market. Whether you prefer the inverse nature of inverse perpetual contracts or the stability of USDT perpetual contracts, both offer unique advantages that can help you achieve your trading goals.