Differenza tra USDT e USDC: A Comprehensive Overview

When it comes to the world of cryptocurrencies, stablecoins have gained significant attention. Two of the most popular stablecoins are Tether (USDT) and USD Coin (USDC). Both aim to provide stability and reliability, but they differ in several key aspects. Let’s delve into the differences between USDT and USDC, exploring their features, use cases, and the communities that support them.

1. Underlying Assets

USDT and USDC are both backed by fiat currencies, but they differ in the assets that back them. USDT is backed by a basket of assets, including fiat currencies and other cryptocurrencies. On the other hand, USDC is fully backed by the US dollar, with each USDC coin representing one US dollar in reserve.

| Stablecoin | Underlying Assets |

|---|---|

| USDT | Fiat currencies and other cryptocurrencies |

| USDC | US dollars |

2. Issuance and Regulation

USDT is issued by Tether Limited, a company based in the British Virgin Islands. The company has faced scrutiny from regulators and the public regarding its reserve holdings and transparency. In contrast, USDC is issued by Circle, a financial technology company based in the United States. Circle has been more transparent about its reserve holdings and has received regulatory approval from the New York State Department of Financial Services (NYDFS).

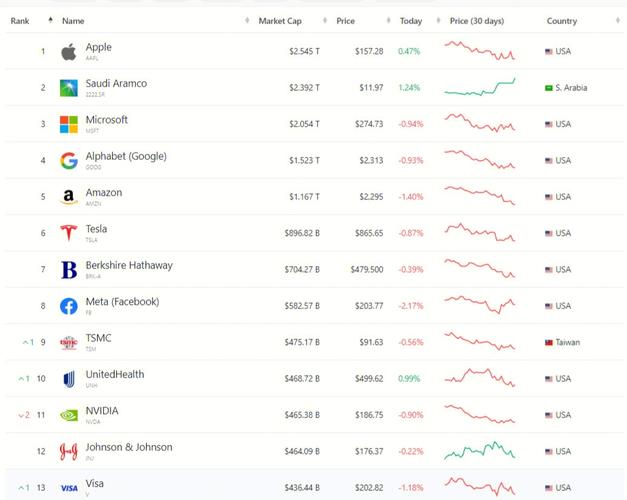

3. Market Cap and Liquidity

USDT has a larger market cap than USDC, making it the most widely used stablecoin. This is due to its long-standing presence in the market and its widespread adoption by exchanges and traders. USDC, while smaller in market cap, has been gaining traction and is increasingly being used for various applications, including decentralized finance (DeFi) projects.

4. Use Cases

USDT and USDC have different use cases within the cryptocurrency ecosystem. USDT is often used for trading and liquidity purposes, as it is widely accepted by exchanges and traders. It is also used for cross-border payments and remittances. USDC, on the other hand, is gaining popularity in DeFi projects, where its transparency and regulatory compliance make it a preferred choice for developers and users.

5. Community and Ecosystem

The communities surrounding USDT and USDC are distinct. The USDT community is larger and more diverse, with a significant presence in Asia. The community has been active in promoting the use of USDT for various applications. The USDC community, while smaller, is highly engaged and focused on fostering innovation within the DeFi space.

6. Security and Trust

Security and trust are crucial factors when it comes to stablecoins. USDT has faced criticism regarding its transparency and reserve holdings, which has raised concerns about its trustworthiness. In contrast, USDC has been praised for its transparency and regulatory compliance, which has helped build trust within the community.

7. Future Prospects

The future of USDT and USDC remains uncertain, but both have the potential to continue growing within the cryptocurrency ecosystem. As the market evolves, the demand for stablecoins is expected to increase, and both USDT and USDC are well-positioned to cater to this demand. However, the success of each stablecoin will depend on their ability to adapt to changing market conditions and regulatory requirements.

In conclusion, USDT and USDC are two popular stablecoins with distinct features and use cases. While USDT has a larger market cap and a more diverse community, USDC is gaining traction in the DeFi space and has been praised for its transparency and regulatory compliance. As the cryptocurrency market continues to evolve, both stablecoins have the potential to play a significant role in shaping the future of digital finance.