Understanding Binance Chain USDT: A Comprehensive Guide

Binance Chain USDT, also known as Tether (USDT), has become a popular choice for traders and investors looking for a stablecoin on the Binance Chain platform. In this article, we will delve into the details of Binance Chain USDT, exploring its features, benefits, and how it compares to other stablecoins in the market.

What is Binance Chain USDT?

Binance Chain USDT is a stablecoin that is pegged to the US dollar. It is designed to maintain a stable value, making it an attractive option for those who want to avoid the volatility associated with traditional cryptocurrencies. Binance Chain USDT is built on the Binance Chain, which is a decentralized blockchain platform that offers fast and low-cost transactions.

How Does Binance Chain USDT Work?

Binance Chain USDT operates through a process called over-collateralization. This means that for every USDT token in circulation, there is a corresponding amount of fiat currency (US dollars) held in reserve. This reserve is managed by Tether Limited, the company behind USDT. The over-collateralization ensures that the value of USDT remains stable, regardless of market conditions.

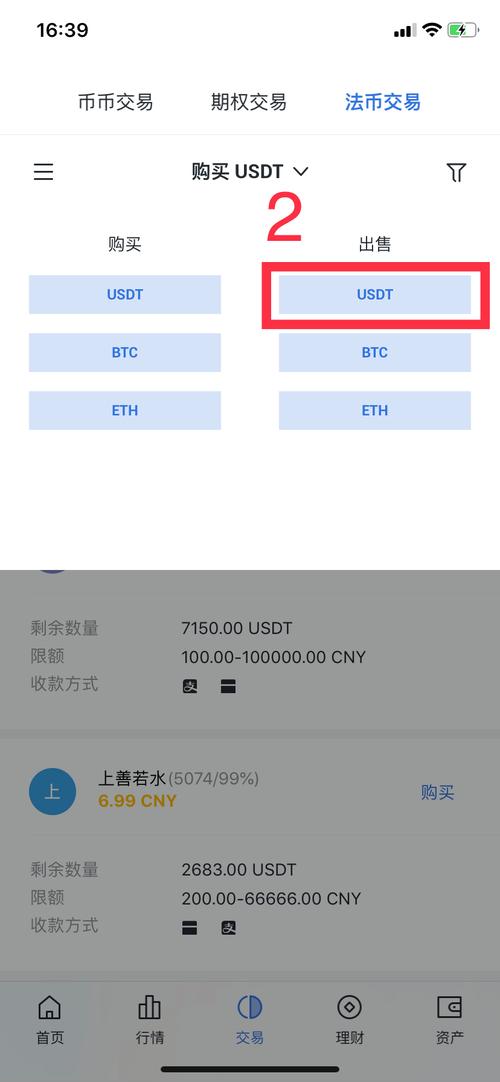

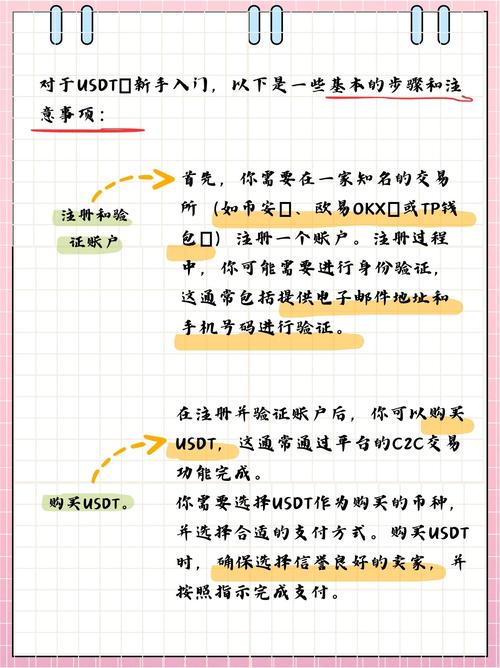

When you purchase Binance Chain USDT, you are essentially exchanging your fiat currency for USDT tokens. Similarly, when you sell USDT, you receive the equivalent amount of fiat currency back. This process is facilitated by various exchanges and trading platforms that support Binance Chain USDT.

Benefits of Binance Chain USDT

There are several benefits to using Binance Chain USDT:

-

Stability: As a stablecoin, Binance Chain USDT offers a stable value, making it an ideal choice for those who want to avoid the volatility of cryptocurrencies.

-

Transparency: The Binance Chain platform is known for its transparency, with all transactions recorded on the blockchain. This ensures that users can trust the system and verify the value of their USDT tokens.

-

Accessibility: Binance Chain USDT is widely supported by various exchanges and trading platforms, making it easy for users to buy, sell, and trade USDT tokens.

-

Low Transaction Fees: Binance Chain offers low transaction fees, making it cost-effective for users to send and receive USDT tokens.

Comparison with Other Stablecoins

When comparing Binance Chain USDT with other stablecoins, there are a few key factors to consider:

| Stablecoin | Binance Chain USDT | USDC | PAX |

|---|---|---|---|

| Blockchain Platform | Binance Chain | ETH | ERC-20 |

| Collateralization | Over-collateralized | Over-collateralized | Over-collateralized |

| Market Cap | $20 billion | $25 billion | $10 billion |

| Transaction Fees | Low | Low | Low |

As seen in the table above, Binance Chain USDT is over-collateralized like USDC and PAX, but it has a lower market cap compared to USDC. This indicates that Binance Chain USDT is still growing in popularity and adoption.

Conclusion

Binance Chain USDT is a stablecoin that offers several advantages for traders and investors. Its stability, transparency, and low transaction fees make it an attractive option for those looking to avoid the volatility of traditional cryptocurrencies. As the Binance Chain platform continues to grow, it is likely that Binance Chain USDT will become an even more popular choice for users worldwide.