Understanding DEFI Liquidity Mining with USDT: A Comprehensive Guide

Are you intrigued by the concept of DEFI liquidity mining and its potential with USDT? If so, you’ve come to the right place. In this detailed guide, we’ll delve into the ins and outs of DEFI liquidity mining using USDT, exploring its benefits, risks, and how it works. Let’s get started.

What is DEFI Liquidity Mining?

DEFI liquidity mining is a process where users can earn rewards by providing liquidity to decentralized finance (DEFI) platforms. These platforms use the provided liquidity to facilitate various financial services, such as lending, borrowing, and trading. By participating in liquidity mining, users can earn tokens or other rewards in return for their contributions.

Understanding USDT

USDT, or Tether, is a popular stablecoin that is backed by fiat currencies, primarily the US dollar. It is designed to maintain a stable value, making it an attractive option for users looking to avoid the volatility of cryptocurrencies. USDT is widely used in DEFI platforms due to its stability and ease of use.

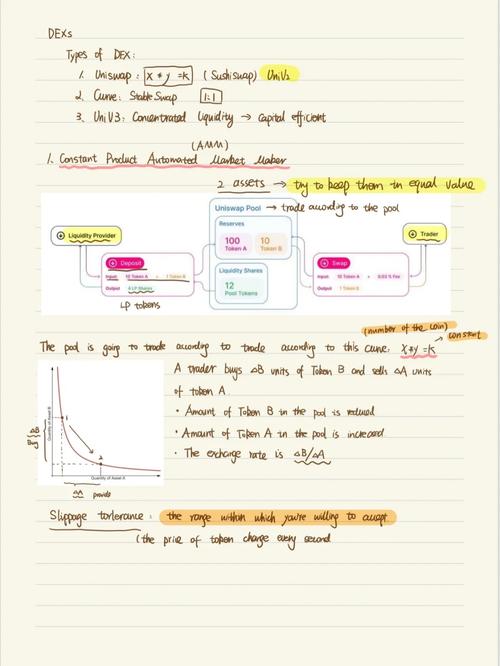

How DEFI Liquidity Mining with USDT Works

When you participate in DEFI liquidity mining with USDT, you are essentially lending your USDT to a DEFI platform. The platform then uses this liquidity to facilitate various financial services. In return, you receive rewards in the form of tokens or other rewards.

Here’s a step-by-step breakdown of the process:

- Choose a DEFI platform that supports liquidity mining with USDT.

- Deposit your USDT into the platform’s liquidity pool.

- The platform uses your USDT to facilitate financial services.

- You earn rewards in the form of tokens or other rewards based on your contribution.

Benefits of DEFI Liquidity Mining with USDT

There are several benefits to participating in DEFI liquidity mining with USDT:

- Stable Rewards: Since USDT is a stablecoin, your rewards are less likely to be affected by market volatility.

- Low Risk: Compared to other cryptocurrencies, USDT is considered to be a low-risk investment.

- High Liquidity: USDT is widely accepted and can be easily converted to other cryptocurrencies or fiat currencies.

- Access to DEFI Services: By participating in liquidity mining, you gain access to various DEFI services, such as lending, borrowing, and trading.

Risks of DEFI Liquidity Mining with USDT

While DEFI liquidity mining with USDT offers several benefits, it’s important to be aware of the risks involved:

- Market Volatility: Although USDT is a stablecoin, the overall cryptocurrency market can still be volatile, which may affect your rewards.

- Platform Risk: There is always a risk that the DEFI platform you are using may face issues, such as security breaches or technical failures.

- Liquidity Pool Risk: If the liquidity pool becomes too concentrated in a particular asset, it may become vulnerable to manipulation or market movements.

Top DEFI Platforms for Liquidity Mining with USDT

Here are some of the top DEFI platforms that offer liquidity mining with USDT:

| Platform | Features | Supported Tokens |

|---|---|---|

| Uniswap | Decentralized exchange, liquidity mining | USDT, ETH, BTC, and more |

| Compound | Debt protocol, liquidity mining | USDT, ETH, and more |

| AAVE | Debt protocol, liquidity mining | USDT, ETH, and more |

How to Get Started with DEFI Liquidity Mining with USDT

Getting started with DEFI liquidity mining with USDT is relatively straightforward:

<