Understanding USD to USDT Transfer

Are you looking to send USDT to USD using Transferwise? If so, you’ve come to the right place. In this detailed guide, we’ll explore the process, benefits, and considerations involved in making a USDT to USD transfer through Transferwise. Let’s dive in.

What is USDT?

USDT, or Tether, is a type of cryptocurrency that is designed to be a stablecoin. Unlike other cryptocurrencies, USDT is backed by fiat currencies, primarily the US dollar. This means that the value of USDT is intended to be stable and closely tied to the value of the US dollar.

Understanding Transferwise

Transferwise is a popular international money transfer service that allows users to send money across borders with low fees and competitive exchange rates. It operates by connecting users with local bank accounts in different countries, enabling seamless and cost-effective transfers.

How to Send USDT to USD Using Transferwise

Here’s a step-by-step guide on how to send USDT to USD through Transferwise:

-

Sign up for a Transferwise account if you haven’t already.

-

Log in to your Transferwise account and select the “Send Money” option.

-

Choose the currency pair you want to send, in this case, USDT to USD.

-

Enter the amount of USDT you want to send. Keep in mind that Transferwise may charge a fee for the transaction.

-

Select the recipient’s country and provide their bank account details.

-

Review the transaction details and confirm the transfer.

-

Transferwise will process the transaction and send the USD to the recipient’s bank account.

Benefits of Using Transferwise for USDT to USD Transfers

There are several advantages to using Transferwise for USDT to USD transfers:

-

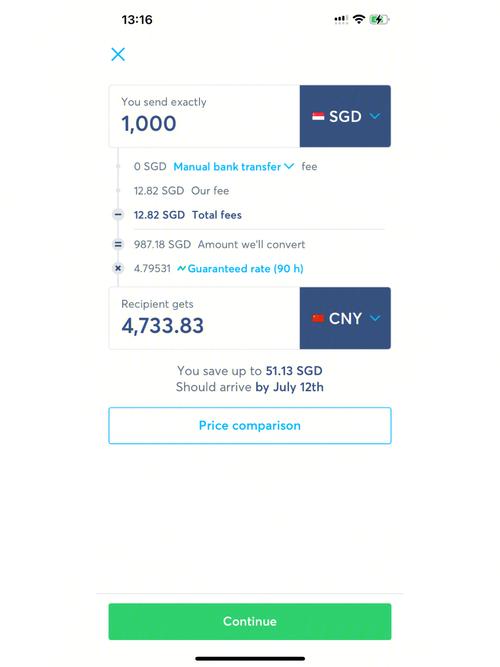

Competitive Exchange Rates: Transferwise offers competitive exchange rates, which can save you money compared to traditional banks.

-

Low Fees: Transferwise charges lower fees compared to many other money transfer services.

-

Fast Transfers: The transfer process is usually quick, with funds arriving in the recipient’s bank account within a few days.

-

Security: Transferwise employs robust security measures to protect your transactions.

Considerations for USDT to USD Transfers

While using Transferwise for USDT to USD transfers offers many benefits, there are a few considerations to keep in mind:

-

Exchange Rate Fluctuations: The value of USDT can fluctuate, so it’s essential to monitor the exchange rate before making a transfer.

-

Transaction Limits: Transferwise may have limits on the amount you can send in a single transaction, so plan accordingly.

-

Recipient’s Bank Details: Ensure that you have the correct bank account details for the recipient to avoid delays or errors.

Table: Comparison of Transferwise and Traditional Banks

| Feature | Transferwise | Traditional Banks |

|---|---|---|

| Exchange Rates | Competitive | Less Competitive |

| Fees | Low | High |

| Transfer Speed | Fast | Slow |

| Security | Robust | Good |

Conclusion

Using Transferwise to send USDT to USD offers a convenient, cost-effective, and secure solution for international money transfers. By following the steps outlined in this guide