BTC and USDT: A Comprehensive Guide

When it comes to cryptocurrencies, Bitcoin (BTC) and Tether (USDT) are two of the most prominent and widely used digital assets. Whether you’re a seasoned investor or just dipping your toes into the crypto world, understanding these two currencies is crucial. In this article, we’ll delve into the details of BTC and USDT, covering their history, features, market performance, and more.

Bitcoin (BTC)

Bitcoin, often referred to as the “gold standard” of cryptocurrencies, was created by an anonymous person or group of people using the pseudonym Satoshi Nakamoto in 2009. It was the first decentralized digital currency, meaning it operates independently of any central authority, such as a government or financial institution.

Bitcoin’s supply is capped at 21 million coins, making it a deflationary asset. This scarcity has contributed to its value over time, as demand has increased while the supply remains constant. Bitcoin’s blockchain technology, known as the Bitcoin network, is responsible for recording and verifying all transactions made with the cryptocurrency.

Here are some key features of Bitcoin:

- Decentralization: Bitcoin operates on a decentralized network, meaning no single entity has control over the currency.

- Scarcity: The limited supply of 21 million coins ensures that Bitcoin is deflationary, potentially increasing its value over time.

- Security: The blockchain technology used by Bitcoin ensures that transactions are secure and cannot be altered or deleted.

- Transparency: All Bitcoin transactions are recorded on the blockchain, making them transparent and verifiable.

Tether (USDT)

Tether, often abbreviated as USDT, is a cryptocurrency that aims to bridge the gap between traditional fiat currencies and the crypto world. It is a stablecoin, meaning its value is pegged to a fiat currency, in this case, the US dollar (USD). Tether was launched in 2014 by Tether Limited, a company based in Hong Kong.

One of the main advantages of USDT is its stability. While Bitcoin and other cryptocurrencies can be highly volatile, USDT maintains a value of $1, making it an ideal currency for transactions and storing wealth. Tether is also widely used for trading and as a medium of exchange in the crypto market.

Here are some key features of Tether (USDT):

- Stability: USDT is pegged to the US dollar, ensuring a stable value of $1.

- Transparency: Tether Limited regularly publishes reports detailing the amount of USD reserves backing each USDT token.

- Accessibility: USDT is available on most major cryptocurrency exchanges and wallets.

- Use Cases: USDT is widely used for trading, paying for goods and services, and as a medium of exchange.

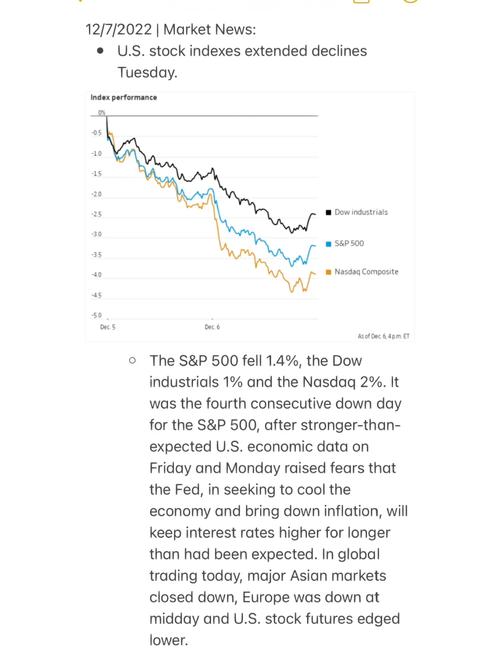

Market Performance

Bitcoin and Tether have both experienced significant growth since their inception. Below is a table comparing their market performance over the years:

| Year | Bitcoin (BTC) | Tether (USDT) |

|---|---|---|

| 2014 | $0.00007 | $0.00048 |

| 2017 | $1,000 | $0.99 |

| 2021 | $50,000 | $1.00 |

As you can see, Bitcoin has experienced exponential growth, while Tether has maintained a stable value of $1. This highlights the differences in their purposes and market dynamics.

Conclusion

Bitcoin and Tether are two of the most important cryptocurrencies in the market today. Bitcoin’s decentralized nature and capped supply make it a valuable asset for long-term investors, while Tether’s stability and wide adoption make it an ideal currency for daily transactions and trading. Understanding the features and market performance of these two currencies can help you make informed decisions in the crypto world.