BTC/USDT: A Comprehensive Guide to Understanding the Cryptocurrency Pair

When it comes to the world of cryptocurrencies, the BTC/USDT pair is one of the most popular and widely traded. Whether you’re a seasoned investor or just dipping your toes into the crypto market, understanding this pair is crucial. In this article, we’ll delve into the details of BTC/USDT, covering its history, trading dynamics, and key factors to consider when investing.

What is BTC/USDT?

BTC/USDT refers to the trading pair of Bitcoin (BTC) and Tether (USDT). Bitcoin is the first and most well-known cryptocurrency, while Tether is a stablecoin designed to maintain a stable value of $1. The BTC/USDT pair allows traders to buy and sell Bitcoin using Tether as the medium of exchange.

History of BTC/USDT

The BTC/USDT pair was introduced in 2015, shortly after the launch of Tether. Initially, it was traded on Bitfinex, one of the largest cryptocurrency exchanges at the time. Since then, the pair has gained significant popularity and is now available on numerous exchanges worldwide.

Trading Dynamics of BTC/USDT

When trading BTC/USDT, it’s essential to understand the dynamics of the market. Here are some key points to consider:

-

Market Liquidity: BTC/USDT is one of the most liquid cryptocurrency pairs, which means it’s easy to buy and sell without significantly impacting the price.

-

Volatility: Bitcoin is known for its high volatility, and this can be reflected in the BTC/USDT pair. Traders should be prepared for rapid price movements and manage their risk accordingly.

-

Market Hours: BTC/USDT trading is available 24/7, but trading volumes tend to be higher during certain hours, such as during the Asian trading session.

Key Factors to Consider When Investing in BTC/USDT

Before investing in BTC/USDT, it’s crucial to consider several factors to make informed decisions:

Market Analysis

Understanding the market trends and analysis is essential for successful trading. Here are some key aspects to consider:

-

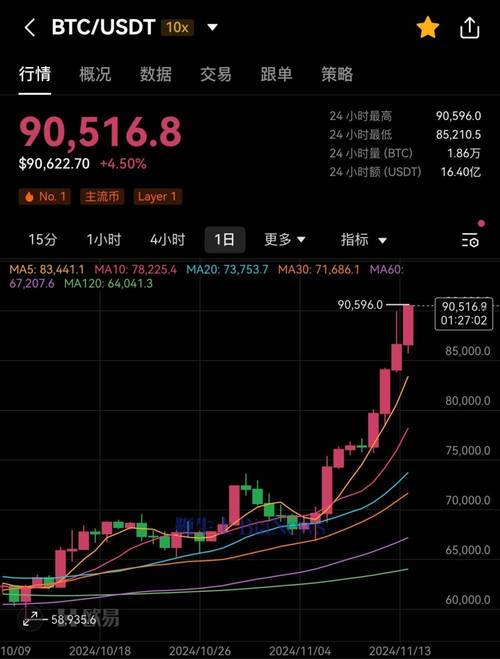

Technical Analysis: Traders often use technical analysis tools, such as charts and indicators, to predict future price movements. This involves analyzing historical price data and identifying patterns or trends.

-

Fundamental Analysis: Some traders focus on fundamental analysis, which involves evaluating the underlying factors that affect the value of Bitcoin and Tether, such as supply and demand, regulatory news, and technological advancements.

Risk Management

Managing risk is crucial when trading cryptocurrencies. Here are some risk management strategies to consider:

-

Stop-Loss Orders: Setting a stop-loss order can help limit potential losses by automatically selling your position when the price reaches a certain level.

-

Position Sizing: Avoid investing more than you can afford to lose. Determine the appropriate position size based on your risk tolerance and investment capital.

-

Diversification: Consider diversifying your portfolio by investing in other cryptocurrencies or assets to spread out your risk.

Exchange Selection

Selecting the right exchange is crucial for a smooth trading experience. Here are some factors to consider when choosing an exchange:

-

Security: Ensure the exchange has robust security measures, such as two-factor authentication and cold storage for funds.

-

Trading Fees: Compare the trading fees of different exchanges to find the most cost-effective option.

-

Available Pairs: Check if the exchange offers BTC/USDT trading and other pairs you’re interested in.

Conclusion

BTC/USDT is a popular and widely traded cryptocurrency pair that offers investors a way to buy and sell Bitcoin using Tether as the medium of exchange. Understanding the trading dynamics, key factors to consider, and risk management strategies is crucial for successful investing. By conducting thorough market analysis, managing risk, and selecting the right exchange, you can make informed decisions and potentially achieve profitable returns in the BTC/USDT market.