BTC/USDT Futures: A Comprehensive Guide for Traders

Understanding the intricacies of BTC/USDT futures can be a game-changer for cryptocurrency traders. By delving into the details, you can make informed decisions and potentially maximize your returns. Let’s explore this exciting trading instrument from various angles.

What are BTC/USDT Futures?

BTC/USDT futures are financial contracts that allow traders to speculate on the future price of Bitcoin (BTC) relative to Tether (USDT), a stablecoin. These contracts are settled in USDT, making them a popular choice for traders looking to hedge their Bitcoin positions or speculate on the price movement without owning the actual cryptocurrency.

How Do BTC/USDT Futures Work?

BTC/USDT futures operate similarly to traditional stock or commodity futures. Traders can take long or short positions based on their market outlook. Here’s a breakdown of the key components:

-

Long Position: A trader expects the price of BTC to increase. By taking a long position, they agree to buy BTC at a predetermined price (the contract price) at a future date (the expiration date).

-

Short Position: A trader expects the price of BTC to decrease. By taking a short position, they agree to sell BTC at a predetermined price at a future date.

-

Contract Size: The contract size represents the amount of BTC that will be delivered or received upon expiration. For example, a contract size of 1 BTC means that the trader is obligated to buy or sell 1 BTC.

-

Expiration Date: The date on which the futures contract matures and the trader must fulfill their obligations.

Benefits of Trading BTC/USDT Futures

Trading BTC/USDT futures offers several advantages over other trading instruments:

-

Leverage: Traders can control a larger amount of BTC with a smaller initial investment, thanks to leverage. This allows for higher potential returns but also increases risk.

-

Hedging: Traders can protect their Bitcoin positions against market volatility by taking opposite positions in the futures market.

-

Access to Global Markets: BTC/USDT futures are traded on various exchanges, providing access to global markets and liquidity.

-

Regulatory Compliance: Many exchanges offer BTC/USDT futures with regulatory oversight, ensuring a level of security and transparency.

Choosing a BTC/USDT Futures Exchange

Selecting the right exchange is crucial for a successful trading experience. Here are some factors to consider:

-

Liquidity: Choose an exchange with high trading volume to ensure tight bid-ask spreads and quick execution.

-

Security: Look for exchanges with robust security measures, such as cold storage for funds and two-factor authentication.

-

Regulatory Compliance: Opt for exchanges that adhere to regulatory standards to ensure a level of security and transparency.

-

Trading Fees: Compare the fees charged by different exchanges to find the most cost-effective option.

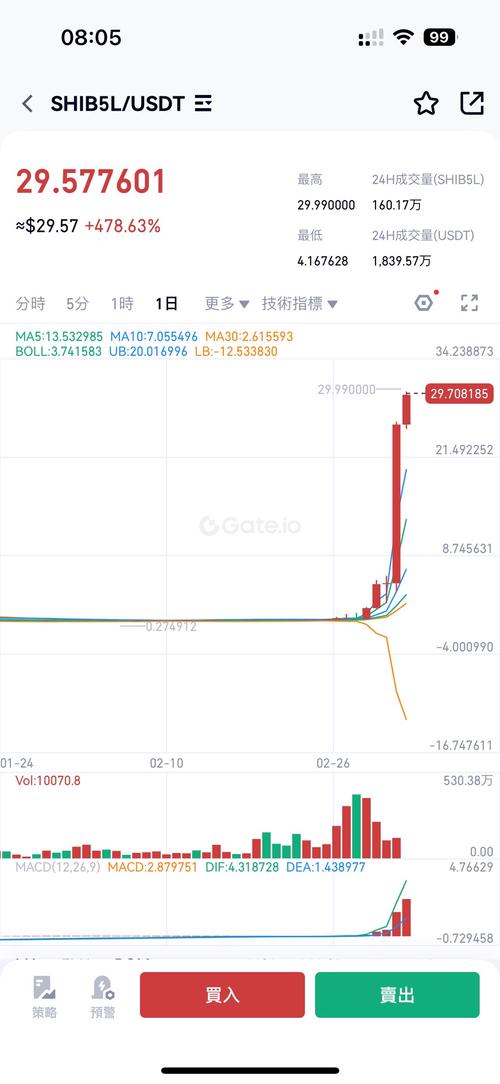

Understanding BTC/USDT Futures Pricing

The price of BTC/USDT futures is influenced by various factors, including market sentiment, supply and demand, and underlying Bitcoin price movements. Here’s a closer look at some key aspects:

-

Spot Price: The current market price of Bitcoin. BTC/USDT futures prices often closely follow the spot price but may deviate due to factors like leverage and market sentiment.

-

Funding Rate: The interest rate charged or paid for holding a position overnight. A positive funding rate indicates that long positions are paying short positions, while a negative funding rate indicates the opposite.

-

Implied Volatility: A measure of the market’s expectation of future price movements. Higher implied volatility often leads to wider bid-ask spreads and higher trading costs.

Strategies for Trading BTC/USDT Futures

Developing a solid trading strategy is essential for success in the BTC/USDT futures market. Here are some popular strategies:

-

Trend Following: Identifying and trading in the direction of the market trend. Traders use technical analysis tools like moving averages and trend lines to identify trends.