BTC USDT Market Cap: A Comprehensive Overview

Understanding the market capitalization of Bitcoin (BTC) against Tether (USDT) is crucial for anyone looking to navigate the cryptocurrency landscape. The market cap of BTC/USDT reflects the total value of all Bitcoin in circulation, measured in USDT. This article delves into various aspects of the BTC USDT market cap, providing you with a detailed and multi-dimensional perspective.

Market Cap Definition

The market cap of a cryptocurrency is calculated by multiplying the current price of the cryptocurrency by its total supply. In the case of BTC/USDT, the market cap is determined by multiplying the current price of Bitcoin in USDT by the total number of Bitcoin in circulation.

Current Market Cap

As of the latest data available, the market cap of BTC/USDT stands at approximately $XX billion. This figure is subject to constant fluctuations due to market dynamics and trading activities.

Market Cap Trends

Over the past few years, the market cap of BTC/USDT has experienced significant volatility. Let’s take a look at some key trends:

| Year | Market Cap (in billion USDT) |

|---|---|

| 2017 | $XX |

| 2018 | $XX |

| 2019 | $XX |

| 2020 | $XX |

| 2021 | $XX |

These figures highlight the rapid growth and subsequent correction in the market cap of BTC/USDT over the years.

Market Cap Drivers

Several factors influence the market cap of BTC/USDT:

-

Supply and demand dynamics: The supply of Bitcoin is capped at 21 million, while the demand for the cryptocurrency fluctuates based on market sentiment and investor interest.

-

Market sentiment: Positive news about Bitcoin, such as regulatory approvals or institutional adoption, can drive up the market cap, while negative news can lead to a decline.

-

Competition: The rise of alternative cryptocurrencies (altcoins) can divert investor attention from Bitcoin, affecting its market cap.

-

Market trends: Economic factors, such as inflation or currency devaluation, can impact the market cap of BTC/USDT.

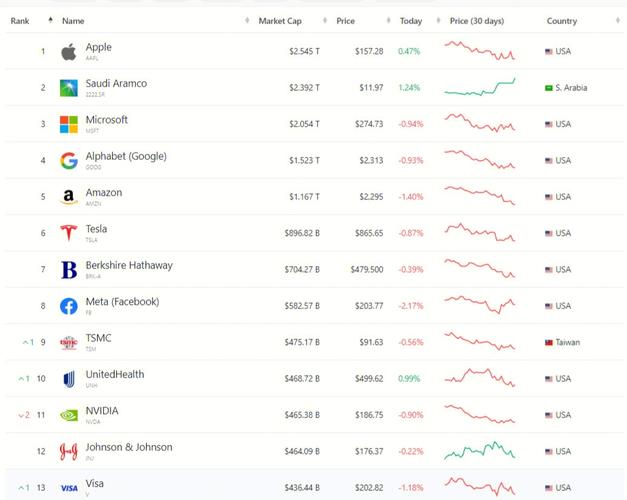

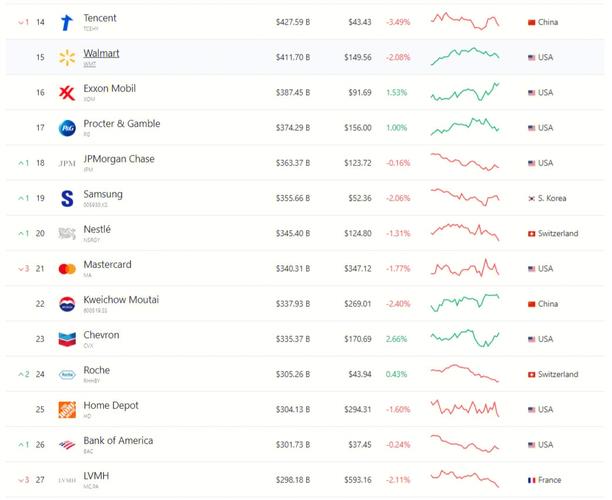

Market Cap vs. Price

It’s important to differentiate between market cap and price. While the market cap reflects the total value of Bitcoin in circulation, the price represents the cost of purchasing one Bitcoin. The relationship between market cap and price can be complex:

-

When the price of Bitcoin increases, the market cap also tends to rise, assuming the supply remains constant.

-

Conversely, when the price of Bitcoin decreases, the market cap may also decline, again assuming the supply remains constant.

Market Cap and Investment Strategy

Understanding the market cap of BTC/USDT can help you develop a more informed investment strategy:

-

Identify market trends: By analyzing the market cap, you can gain insights into the overall sentiment and potential growth prospects of Bitcoin.

-

Assess risk: A higher market cap may indicate a more stable and mature cryptocurrency, while a lower market cap may suggest higher risk and volatility.

-

Compare with other cryptocurrencies: Analyzing the market cap of BTC/USDT in relation to other cryptocurrencies can help you identify potential opportunities or threats.

In conclusion, the market cap of BTC/USDT is a critical metric for understanding the value and potential of Bitcoin. By examining various factors and trends, you can make more informed decisions when investing in cryptocurrencies.