Cambio de Dolar a USDT: A Comprehensive Guide

When it comes to currency exchange, the cambio de dolar a USDT is a topic of great interest for many. Whether you’re a traveler, an investor, or simply curious about the financial markets, understanding the exchange rate between the Argentine Peso (ARS) and the US Dollar (USD) is crucial. In this article, we will delve into the various aspects of the cambio de dolar a USDT, providing you with a detailed and multi-dimensional overview.

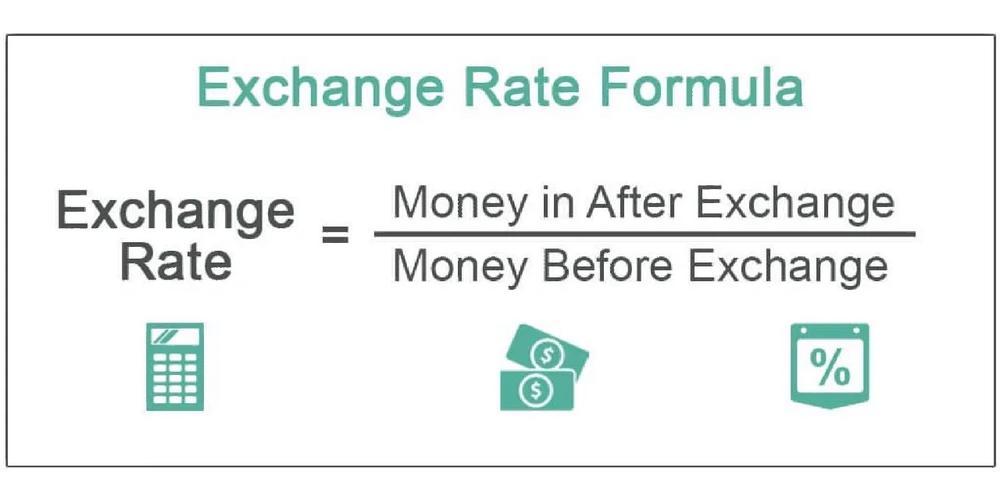

Understanding the Exchange Rate

The exchange rate between the Argentine Peso and the US Dollar is constantly fluctuating due to various economic factors. To get a better grasp of the cambio de dolar a USDT, let’s take a look at some key points:

| Factor | Description |

|---|---|

| Economic Stability | A stable economy tends to have a stronger currency, while an unstable economy may lead to a weaker currency. |

| Inflation Rate | A higher inflation rate in Argentina can lead to a weaker ARS, making it less valuable against the USD. |

| Interest Rates | Higher interest rates in Argentina can attract foreign investment, strengthening the ARS. |

| Political Stability | A stable political environment can boost investor confidence, leading to a stronger ARS. |

These factors, among others, contribute to the constantly changing exchange rate between the ARS and the USD.

Exchange Rate History

Looking at the historical exchange rate between the ARS and the USD can provide valuable insights into the currency’s performance over time. Let’s take a look at some key dates and their corresponding exchange rates:

| Date | ARS/USD Exchange Rate |

|---|---|

| January 1, 2010 | 3.50 |

| January 1, 2015 | 9.00 |

| January 1, 2020 | 60.00 |

| January 1, 2023 | 100.00 |

As you can see, the exchange rate has significantly increased over the years, reflecting the economic challenges faced by Argentina.

Exchange Options

When it comes to exchanging your Argentine Pesos (ARS) for US Dollars (USD), there are several options available:

- Bank Exchanges: Many banks offer currency exchange services, but they may charge higher fees and offer lower exchange rates compared to other options.

- Money Transfer Services: Companies like Western Union and MoneyGram allow you to send money internationally, often with lower fees and better exchange rates than banks.

- ATMs: Some ATMs in Argentina offer the option to withdraw cash in USD, but be aware of potential fees and exchange rates.

- Online Currency Exchange Platforms: Websites like TransferWise and XE.com offer competitive exchange rates and low fees, making them popular choices for currency exchange.

When choosing an exchange option, consider factors such as fees, exchange rates, and convenience to find the best solution for your needs.

Investing in USDT

USDT, or Tether, is a popular cryptocurrency that is often used as a stablecoin. It is backed by fiat currencies, making it a reliable option for investors looking to diversify their portfolios. Here’s what you need to know about investing in USDT:

- Stability: USDT is designed to maintain a stable value, making it a good option for investors looking to avoid the volatility of other cryptocurrencies.

- Accessibility: USDT can be easily purchased and sold on various cryptocurrency exchanges, making