Can You Trust USDT?

When it comes to cryptocurrencies, one of the most frequently discussed topics is the trustworthiness of USDT, a popular stablecoin. In this article, we will delve into the various aspects of USDT to help you determine whether you can trust it.

Understanding USDT

USDT, also known as Tether, is a cryptocurrency that aims to maintain a stable value by being backed by fiat currencies, primarily the US dollar. It was created by Tether Limited, a company based in the British Virgin Islands.

How USDT Works

USDT operates on the blockchain, which means it is decentralized and not controlled by any single entity. When you purchase USDT, you are essentially buying a claim on the underlying fiat currency held in reserve by Tether Limited.

Is USDT Trustworthy?

There are several factors to consider when determining the trustworthiness of USDT:

1. Reserve Backing

One of the most crucial aspects of USDT is its reserve backing. Tether Limited claims that every USDT token is backed by one US dollar in reserve. However, there have been concerns about the transparency of these reserves, with some critics arguing that Tether Limited has not provided sufficient evidence to support its claims.

2. Transparency

Transparency is another critical factor when evaluating the trustworthiness of USDT. While Tether Limited has made some progress in improving its transparency, there is still room for improvement. For instance, the company has not yet disclosed the full details of its reserve assets, which includes cash and cash equivalents, short-term deposits, and other financial instruments.

3. Legal and Regulatory Compliance

USDT operates in a regulatory gray area, as it is neither a traditional fiat currency nor a fully decentralized cryptocurrency. This has raised concerns about its legal and regulatory compliance. While Tether Limited has registered as a money service business in various jurisdictions, it is still facing scrutiny from regulators around the world.

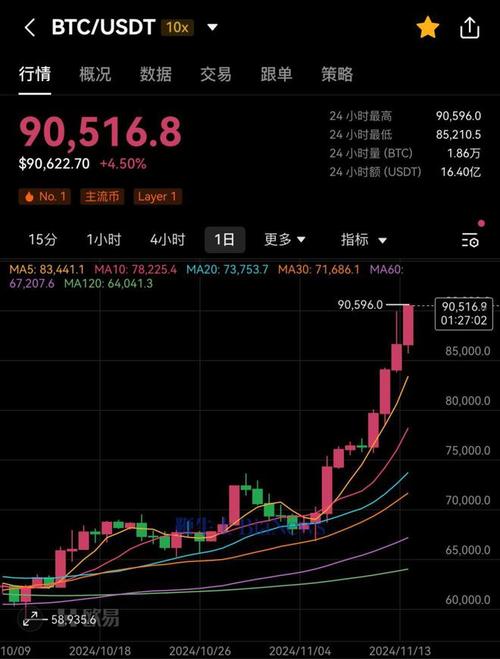

4. Market Reputation

The market reputation of USDT is another important factor to consider. While it is one of the most popular stablecoins, there have been instances where its value has been questioned, leading to market volatility. This has raised concerns about its long-term viability as a stablecoin.

Alternatives to USDT

Given the concerns surrounding USDT, some users may be looking for alternative stablecoins. Here are a few options:

| Stablecoin | Backing | Issuer |

|---|---|---|

| Binance USD (BUSD) | USD | Binance |

| TrueUSD (TUSD) | USD | TrustToken |

| DAI | Collateralized by various assets | MakerDAO |

Conclusion

Deciding whether you can trust USDT depends on your individual risk tolerance and investment goals. While it has its advantages, such as widespread adoption and ease of use, it also comes with its own set of risks and concerns. It is essential to conduct thorough research and consider alternative options before making any investment decisions.