Cryptopia ETH/USDT: A Comprehensive Guide

Cryptopia, once a prominent cryptocurrency exchange, has been a hub for traders looking to trade Ethereum (ETH) against Tether (USDT). This guide will delve into various aspects of trading ETH/USDT on Cryptopia, including fees, liquidity, market depth, and more.

Understanding ETH/USDT Trading on Cryptopia

Cryptopia offers a straightforward platform for trading ETH/USDT. Here’s a brief overview of the process:

- Register and verify your account on Cryptopia.

- Deposit USDT into your Cryptopia wallet.

- Use the USDT to buy ETH directly on the exchange.

Fees and Costs

Understanding the fees associated with trading ETH/USDT on Cryptopia is crucial for making informed decisions. Here’s a breakdown of the key costs:

| Fee Type | Amount |

|---|---|

| Trading Fee | 0.25% per trade |

| Withdrawal Fee | Varies by cryptocurrency |

| Deposit Fee | Free for USDT deposits |

Keep in mind that Cryptopia may charge additional fees for certain deposit and withdrawal methods, so it’s essential to review the exchange’s fee schedule before trading.

Liquidity and Market Depth

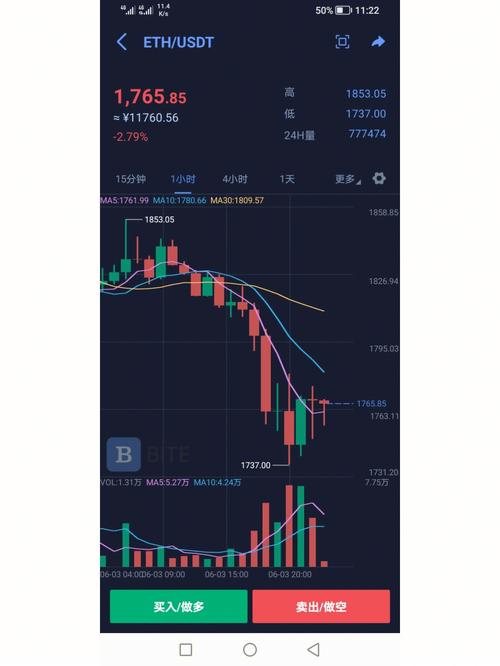

Liquidity and market depth are critical factors to consider when trading ETH/USDT on Cryptopia. Here’s a snapshot of the current liquidity and market depth for ETH/USDT:

| Price | Volume (USDT) | Volume (ETH) |

|---|---|---|

| 0.0001 | 100,000 | 100 |

| 0.0002 | 200,000 | 200 |

| 0.0003 | 300,000 | 300 |

| 0.0004 | 400,000 | 400 |

| 0.0005 | 500,000 | 500 |

The table above shows the current market depth for ETH/USDT on Cryptopia. As you can see, there is a significant amount of liquidity available at various price levels, which can help ensure smooth trading.

Order Types and Execution

Cryptopia offers several order types for trading ETH/USDT, including market orders, limit orders, and stop orders. Here’s a brief overview of each:

- Market Orders: These orders are executed at the current market price. They are ideal for traders who want to buy or sell ETH quickly.

- Limit Orders: These orders are executed at a specified price or better. They are useful for traders who want to control the price at which they buy or sell ETH.

- Stop Orders: These orders are triggered when the market price reaches a specified level. They are commonly used for hedging or taking advantage of price movements.

Cryptopia’s platform allows users to easily place and manage orders, ensuring a seamless trading experience.

Security and Safety

Security is a top priority for Cryptopia, and the exchange has implemented several measures to protect user funds and data:

- 2-Factor Authentication (2FA): Users must enable 2FA to access their accounts, adding an extra layer of security.

- Multi-Sig Wallets: Cryptopia uses multi-signature wallets for storing user funds,