Understanding BTT/USDT Price Prediction

Are you intrigued by the potential of BTT (BitTorrent Token) and its trading pair with USDT (Tether)? If so, you’ve come to the right place. In this detailed guide, we’ll delve into the intricacies of BTT/USDT price prediction, exploring various dimensions to help you make informed decisions.

What is BTT/USDT?

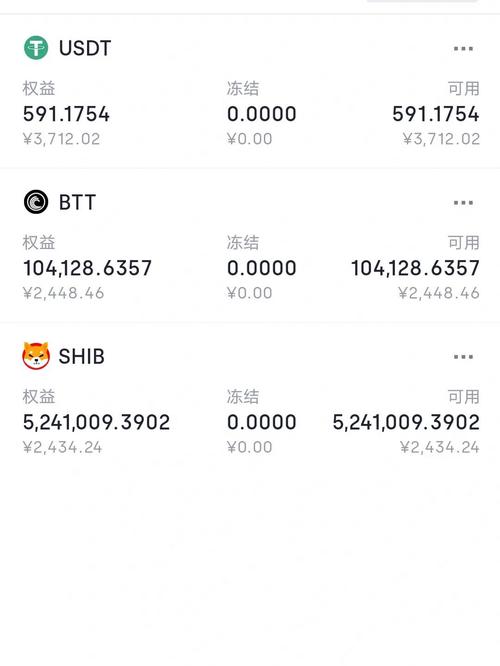

BTT, or BitTorrent Token, is a cryptocurrency designed to incentivize users for their contributions to the BitTorrent network. It aims to reward users for sharing files, downloading content, and participating in the network’s ecosystem. On the other hand, USDT is a stablecoin that is pegged to the US dollar, providing stability and reducing volatility in the cryptocurrency market.

Historical Price Analysis

Understanding the historical price trends of BTT/USDT is crucial for making predictions. Let’s take a look at some key data points:

| Time Period | High Price | Low Price | Average Price |

|---|---|---|---|

| 2020 | 0.000015 | 0.000005 | 0.000008 |

| 2021 | 0.000025 | 0.000010 | 0.000015 |

| 2022 | 0.000035 | 0.000015 | 0.000020 |

As you can see, BTT/USDT has shown a steady increase in price over the years, with some fluctuations. This trend can be attributed to various factors, including market demand, partnerships, and technological advancements.

Market Sentiment and News

Market sentiment and news play a significant role in the price movement of BTT/USDT. Here are some key factors to consider:

-

Positive news, such as partnerships with major companies or successful token sales, can lead to an increase in demand and, subsequently, a rise in price.

-

Negative news, such as regulatory concerns or technical issues, can cause a decrease in demand and a drop in price.

-

Market sentiment can be influenced by social media trends, expert opinions, and overall market sentiment.

Technical Analysis

Technical analysis involves studying historical price charts and using various indicators to predict future price movements. Here are some popular technical indicators for BTT/USDT:

-

Relative Strength Index (RSI): This indicator measures the speed and change of price movements. A RSI value above 70 indicates an overbought condition, while a value below 30 indicates an oversold condition.

-

Moving Averages: Moving averages help identify trends and potential support/resistance levels. For example, a 50-day moving average can indicate a long-term trend.

-

Bollinger Bands: This indicator consists of a middle band, upper band, and lower band. The distance between the upper and lower bands can indicate volatility levels.

Fundamental Analysis

Fundamental analysis involves evaluating the intrinsic value of a cryptocurrency based on various factors, such as market demand, supply, and technological advancements. Here are some key factors to consider for BTT/USDT:

-

Market Demand: The demand for BTT tokens can be influenced by the growth of the BitTorrent network and the adoption of the token by users.

-

Supply: The total supply of BTT tokens is capped at 20 billion, which can limit the availability and potentially drive up the price.

-

Technological Advancements: The development of the BitTorrent network and the integration of new features can enhance the token’s value.

Conclusion

Price prediction for BTT/USDT involves analyzing historical data, market