Understanding DEFI USDT Mining: A Comprehensive Guide

Are you intrigued by the world of decentralized finance (DEFI) and looking to dive into USDT mining? You’ve come to the right place. In this detailed guide, we’ll explore what DEFI USDT mining is, how it works, its benefits, risks, and much more. Let’s get started.

What is DEFI USDT Mining?

DEFI USDT mining refers to the process of validating transactions on a blockchain network and earning USDT tokens in return. USDT is a stablecoin, which means its value is pegged to the US dollar, making it a popular choice for DEFI applications.

How Does DEFI USDT Mining Work?

Here’s a step-by-step breakdown of the DEFI USDT mining process:

-

Join a DEFI platform that supports USDT mining.

-

Deposit USDT into your account on the platform.

-

Start mining by validating transactions on the blockchain network.

-

Earn USDT tokens as rewards for your mining efforts.

It’s important to note that the mining process can vary depending on the platform you choose. Some platforms may require you to download and run a mining software, while others may offer cloud mining services.

Benefits of DEFI USDT Mining

There are several benefits to engaging in DEFI USDT mining:

-

Passive Income: Mining can be a source of passive income, allowing you to earn USDT tokens without actively trading.

-

Stablecoin Value: As USDT is a stablecoin, its value is less volatile compared to other cryptocurrencies, making it a safer investment.

-

Low Entry Barrier: DEFI USDT mining has a relatively low entry barrier, making it accessible to beginners and experienced traders alike.

Risks of DEFI USDT Mining

While DEFI USDT mining has its benefits, it’s important to be aware of the risks involved:

-

Market Volatility: The value of USDT can still be affected by market conditions, which may impact your earnings.

-

High Energy Consumption: Mining requires significant computing power, which can lead to high energy costs.

-

Security Risks: As with any cryptocurrency activity, there are security risks associated with DEFI USDT mining, such as hacking and phishing attacks.

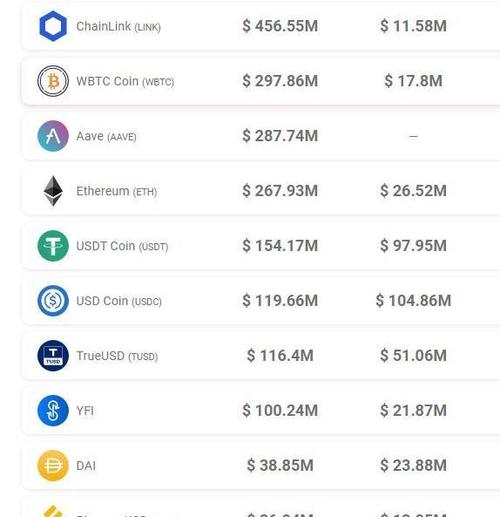

Top DEFI USDT Mining Platforms

Here are some of the top DEFI USDT mining platforms you can consider:

| Platform | Features | Minimum Deposit |

|---|---|---|

| Uniswap | Decentralized exchange, liquidity mining | $50 |

| Compound | Debt and liquidity mining | $100 |

| MakerDAO | Stablecoin lending and borrowing | $50 |

How to Get Started with DEFI USDT Mining

Follow these steps to get started with DEFI USDT mining:

-

Research and choose a reputable DEFI platform that supports USDT mining.

-

Sign up for an account on the platform and verify your identity.

-

Deposit USDT into your account.

-

Choose a mining pool or start mining solo, depending on your preference.

-

Monitor your mining activity and earnings.

Conclusion

DEFI USDT mining can be a lucrative and exciting way to participate in the decentralized finance ecosystem. By understanding the process, benefits, and risks, you