Understanding DOT/USDT Price Prediction: A Comprehensive Guide

Are you intrigued by the potential of DOT/USDT price prediction? If so, you’ve come to the right place. In this detailed guide, we’ll delve into the various aspects of predicting the price of DOT/USDT, a popular cryptocurrency pair. From historical data to technical analysis, we’ll explore the different dimensions that can help you make informed decisions.

Historical Data and Trends

One of the most fundamental aspects of price prediction is analyzing historical data. By examining past price movements, you can identify patterns and trends that may influence future price changes. Let’s take a look at some key historical data points for DOT/USDT:

| Year | High Price (USDT) | Low Price (USDT) | Average Price (USDT) |

|---|---|---|---|

| 2020 | 0.50 | 0.20 | 0.35 |

| 2021 | 5.00 | 1.50 | 3.00 |

| 2022 | 10.00 | 4.00 | 6.00 |

As you can see from the table above, the price of DOT/USDT has experienced significant growth over the past few years. However, it’s important to note that historical data is just one piece of the puzzle. Let’s explore other factors that can impact price predictions.

Market Sentiment and News

Market sentiment and news can have a profound impact on the price of DOT/USDT. Positive news, such as partnerships or successful projects, can drive the price up, while negative news, such as regulatory concerns or security breaches, can cause it to plummet. To stay informed, it’s crucial to keep an eye on the following:

-

Cryptocurrency news websites and forums

-

Official announcements from DOT and Tether (USDT)

-

Regulatory updates and market trends

By staying informed about the latest news and market sentiment, you can better understand the potential risks and opportunities associated with DOT/USDT.

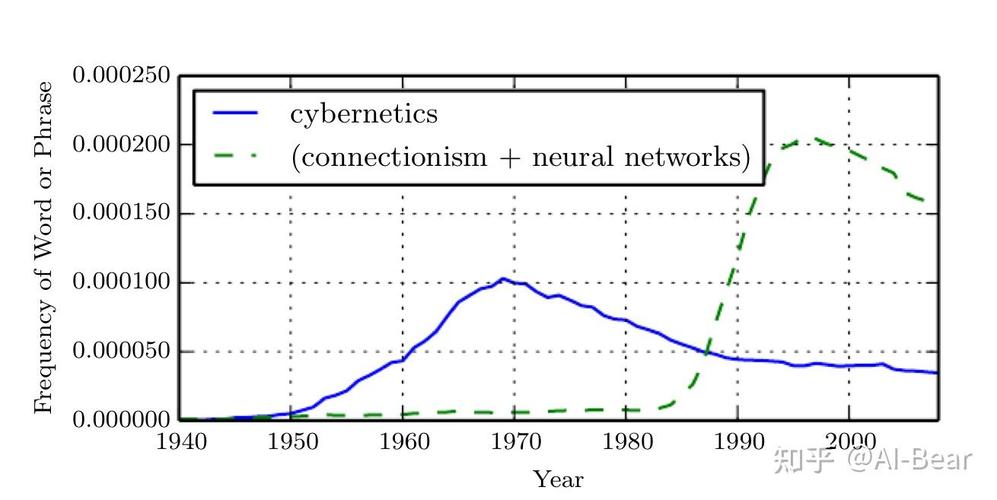

Technical Analysis

Technical analysis involves studying historical price data and using various tools and indicators to predict future price movements. Some popular technical analysis tools for DOT/USDT include:

-

Price charts

-

Volume indicators

-

Moving averages

-

Support and resistance levels

Let’s take a closer look at some of these tools:

Price Charts

Price charts provide a visual representation of the historical price movements of DOT/USDT. By analyzing these charts, you can identify trends, patterns, and potential entry and exit points. Some common types of price charts include line charts, bar charts, and candlestick charts.

Volume Indicators

Volume indicators, such as the Relative Volume (RVOL) or the On-Balance Volume (OBV), help you understand the strength of price movements. A high volume indicates strong interest in the asset, while a low volume may suggest a lack of interest or consolidation.

Moving Averages

Moving averages are a popular tool for smoothing out price data and identifying trends. By calculating the average price over a specific period, you can get a better sense of the overall direction of the market. Some common moving averages include the 50-day, 100-day, and 200-day moving averages.

Support and Resistance Levels

Support and resistance levels are critical price points where the market has historically struggled to move above or below. By identifying these levels, you can anticipate potential price reversals or continuation patterns.

Conclusion

Understanding DOT/USDT price prediction requires a multi-dimensional approach, combining historical data, market sentiment, and technical analysis. By