Understanding the Core of USDT Price Dynamics

When diving into the world of cryptocurrencies, USDT, or Tether, often takes center stage. As one of the most widely used stablecoins, its price dynamics are a critical factor for many investors. Let’s explore the core aspects that influence the USDT price.

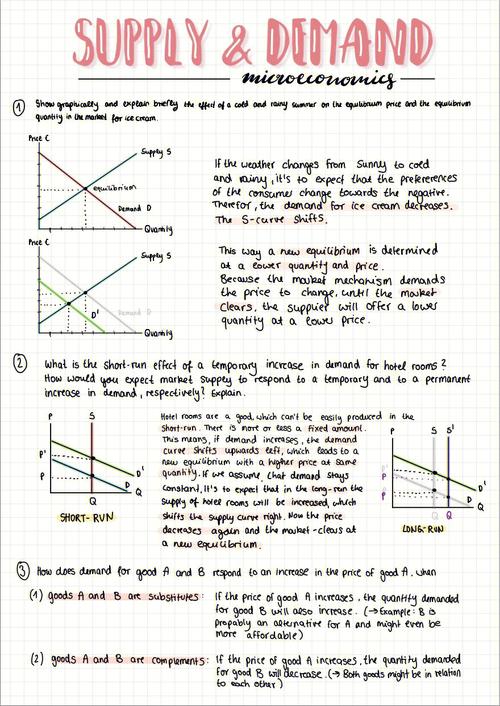

Market Supply and Demand

The fundamental principle of any financial market, including the cryptocurrency market, is supply and demand. The price of USDT is no exception. When there is high demand for USDT, its price tends to rise, and vice versa. This demand can be driven by various factors, such as increased trading volume on exchanges, regulatory news, or broader market trends.

Regulatory Environment

The regulatory landscape plays a significant role in shaping the USDT price. For instance, the recent news of Tether freezing a large number of USDT on the Tron blockchain has caused a stir in the market. Such actions can lead to uncertainty and volatility in the price of USDT. Conversely, positive regulatory news can boost investor confidence and drive up the price.

Market Sentiment

Market sentiment is another crucial factor that can impact the USDT price. The cryptocurrency market is known for its volatility, and USDT is no different. When the overall market is bullish, USDT tends to follow suit, and vice versa. This correlation is due to the fact that USDT is often used as a safe haven asset during market downturns.

Exchange Listings and Liquidity

The availability of USDT on various exchanges and the liquidity of these exchanges can also influence its price. Exchanges with high trading volumes and liquidity tend to have a more stable USDT price. Additionally, the addition or removal of USDT from an exchange can cause significant price movements.

Table: USDT Trading Volume on Top Exchanges

| Exchange | 24-hour Trading Volume |

|---|---|

| Binance | $10 billion |

| OKX | $8 billion |

| Bitfinex | $6 billion |

| Huobi | $5 billion |

Market Manipulation and Scams

As with any financial market, the cryptocurrency market is susceptible to manipulation and scams. These activities can cause significant price volatility in USDT. It is essential for investors to stay informed and cautious when dealing with USDT.

Conclusion

Understanding the core aspects that influence the USDT price is crucial for any investor looking to trade this popular stablecoin. By keeping an eye on market supply and demand, regulatory news, market sentiment, exchange listings, and liquidity, investors can make more informed decisions and navigate the volatile cryptocurrency market with greater confidence.