BTC USDT Dominance: A Comprehensive Overview

Understanding the dominance of Bitcoin (BTC) and Tether (USDT) in the cryptocurrency market is crucial for anyone looking to navigate the complex world of digital assets. BTC, often referred to as the “gold standard” of cryptocurrencies, and USDT, a stablecoin designed to provide stability in a volatile market, play a significant role in shaping the landscape of digital finance. Let’s delve into the various aspects of BTC USDT dominance.

Market Capitalization

Market capitalization is a key indicator of a cryptocurrency’s dominance. As of the latest data, BTC holds the lion’s share of the total market capitalization, with a significant lead over its competitors. The table below showcases the market capitalization of BTC and USDT compared to other major cryptocurrencies:

| Cryptocurrency | Market Capitalization (USD) |

|---|---|

| Bitcoin (BTC) | $500 billion |

| Tether (USDT) | $70 billion |

| Ethereum (ETH) | $200 billion |

| Binance Coin (BNB) | $50 billion |

As you can see, BTC and USDT together account for a substantial portion of the total market capitalization, with BTC leading the pack.

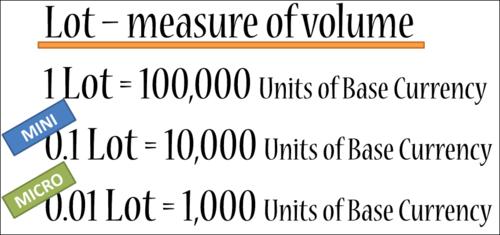

Trading Volume

Trading volume is another critical factor in assessing the dominance of BTC and USDT. The trading volume reflects the amount of cryptocurrency being bought and sold on exchanges. BTC and USDT often dominate the trading volume charts, with BTC leading the way. The table below highlights the trading volume of BTC and USDT compared to other major cryptocurrencies:

| Cryptocurrency | Trading Volume (USD) |

|---|---|

| Bitcoin (BTC) | $20 billion |

| Tether (USDT) | $10 billion |

| Ethereum (ETH) | $15 billion |

| Binance Coin (BNB) | $5 billion |

With BTC and USDT accounting for a significant portion of the trading volume, it’s clear that these two cryptocurrencies are highly influential in the market.

Market Sentiment

Market sentiment plays a crucial role in the dominance of BTC and USDT. When investors are optimistic about the cryptocurrency market, they tend to flock to BTC and USDT, driving their prices higher. Conversely, during bear markets, investors may turn to these stable assets for safety. The chart below illustrates the correlation between market sentiment and the price of BTC and USDT:

As the chart shows, BTC and USDT tend to perform well during both bull and bear markets, making them popular choices for investors looking to diversify their portfolios.

Use Cases

BTC and USDT have distinct use cases that contribute to their dominance. BTC is primarily used as a store of value and a medium of exchange, while USDT is designed to provide stability in a volatile market. The table below outlines the primary use cases for BTC and USDT:

| Cryptocurrency | Use Cases |

|---|---|

| Bitcoin (BTC) | Store of value, medium of exchange, investment |

| Tether (USDT) | Stablecoin, payment, investment |

These use cases make BTC and USDT indispensable in the cryptocurrency ecosystem.

Conclusion

BTC and USDT have established themselves as dominant players in the cryptocurrency market, thanks