Understanding APY on USDT: A Comprehensive Guide

Are you curious about the concept of Annual Percentage Yield (APY) on USDT? If so, you’ve come to the right place. In this detailed guide, we will delve into what APY is, how it applies to USDT, and the various factors that influence it. By the end of this article, you’ll have a clearer understanding of this financial term and its relevance to the world of stablecoins.

What is APY?

APY, or Annual Percentage Yield, is a financial term used to describe the rate of return on an investment over a year. It takes into account the effect of compounding, which means that the interest earned on your investment is reinvested, leading to higher returns over time.

APY is often used to compare different investment options, such as savings accounts, certificates of deposit (CDs), and bonds. It’s important to note that APY is an annualized rate, meaning it’s calculated based on the assumption that the interest is compounded once per year.

Understanding USDT

USDT, or Tether, is a popular stablecoin that is backed by fiat currencies, primarily the US dollar. Unlike other cryptocurrencies, USDT is designed to maintain a stable value, making it an attractive option for investors and traders looking for a less volatile asset.

USDT is available in two forms: fiat-collateralized and crypto-collateralized. The fiat-collateralized version is backed by a reserve of US dollars, while the crypto-collateralized version is backed by a basket of cryptocurrencies.

APY on USDT: How Does It Work?

APY on USDT refers to the rate of return you can earn by investing in USDT. This rate can vary depending on the platform or service you choose to invest in. Here’s a breakdown of how APY on USDT works:

-

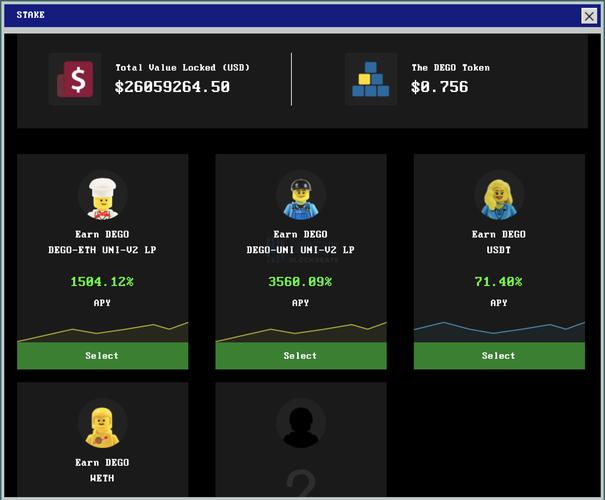

Investment Platforms: Many platforms offer USDT-based investment opportunities, such as lending, staking, and liquidity mining. These platforms provide APY rates that reflect the potential returns on your investment.

-

Market Conditions: The APY on USDT can be influenced by market conditions, such as the demand for stablecoins and the overall interest rates in the financial market.

-

Platform Fees: Some platforms may charge fees for using their services, which can affect the actual APY you earn.

Factors Influencing APY on USDT

Several factors can influence the APY on USDT, including:

| Factor | Description |

|---|---|

| Market Demand | The demand for USDT can affect its price and, consequently, the APY offered by investment platforms. |

| Interest Rates | Higher interest rates can lead to higher APYs on USDT investments, as platforms may offer better returns to attract investors. |

| Platform Competition | Competition among investment platforms can drive up APYs, as they try to attract more users. |

| Transaction Fees | Transaction fees can reduce the actual APY you earn, as they are deducted from your investment returns. |

Comparing APYs on USDT

When comparing APYs on USDT, it’s important to consider the following factors:

-

Platform Reputation: Choose a reputable platform with a good track record of paying out returns.

-

APY Rate: Look for platforms offering competitive APY rates, but also consider the risk involved.

-

Minimum Investment Amount: Some platforms may require a minimum investment amount, which can affect your potential returns.

-

Duration of Investment: Longer investment durations can lead to higher returns, but they also come with increased risk.

Risks and Considerations

While investing in USDT can offer attractive APYs, it’s important to be aware of the risks involved: