Understanding USDT and BUSD: A Comprehensive Comparison

When it comes to the world of cryptocurrencies, stablecoins have emerged as a crucial component. Two of the most popular stablecoins are Tether (USDT) and Binance USD (BUSD). Both aim to provide stability and reliability, but they differ in several key aspects. Let’s delve into the differences between USDT and BUSD, exploring their features, use cases, and the communities that support them.

1. Issuance and Underlying Assets

USDT is a stablecoin issued by Tether Limited, a company based in the British Virgin Islands. It is backed by a basket of fiat currencies, primarily the US dollar. Each USDT token is supposed to be backed by one US dollar, ensuring its value remains stable. The company maintains a reserve of assets to support the USDT tokens in circulation.

BUSD, on the other hand, is issued by Binance, one of the largest cryptocurrency exchanges in the world. Similar to USDT, BUSD is also backed by fiat currencies, primarily the US dollar. However, Binance has a more transparent approach, as it publishes the reserve ledger on its website, allowing users to verify the backing of BUSD.

2. Blockchain Technology

USDT is available on multiple blockchain platforms, including Ethereum, Tron, and Omni Layer. This allows users to choose the platform that suits their needs and preferences. The Ethereum-based version of USDT, known as USDT-ERC20, is the most widely used and has the highest liquidity.

BUSD is primarily available on the Binance Smart Chain (BSC), which is a blockchain platform designed to offer low transaction fees and high scalability. This makes BUSD an attractive option for users looking to perform transactions on the BSC network.

3. Transaction Fees and Speed

USDT offers competitive transaction fees and speeds, especially on the Ethereum network. The Ethereum-based USDT-ERC20 has low transaction fees, making it an affordable option for users. However, the transaction speed can vary depending on the network congestion.

BUSD also offers low transaction fees and high-speed transactions on the BSC network. The fees are generally lower than those on the Ethereum network, making it an even more cost-effective option for users.

4. Regulatory Compliance and Transparency

USDT has faced criticism regarding its regulatory compliance and transparency. While Tether Limited claims to be compliant with all relevant regulations, some users and experts have raised concerns about the company’s transparency in disclosing its reserve assets.

BUSD, on the other hand, has been praised for its transparency. Binance publishes the reserve ledger on its website, allowing users to verify the backing of BUSD. This has helped build trust among users and has made BUSD a more attractive option for those concerned about regulatory compliance and transparency.

5. Use Cases and Community Support

USDT has become a popular choice for users looking to trade cryptocurrencies, as it can be used to avoid the volatility associated with other digital assets. It is widely accepted on various exchanges and platforms, making it a convenient option for users to move between different cryptocurrencies.

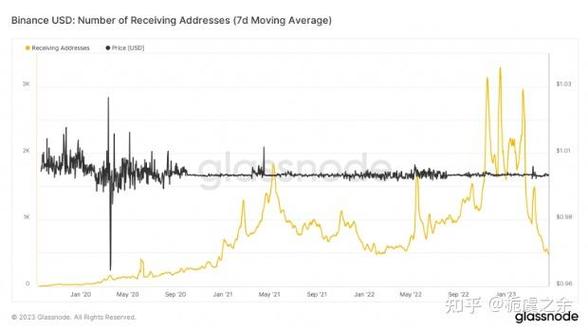

BUSD has gained popularity among users on the BSC network, as it offers a stable and reliable option for transactions. Its integration with Binance’s ecosystem has also helped in building a strong community around BUSD.

6. Conclusion

In conclusion, USDT and BUSD are both popular stablecoins with their unique features and advantages. While USDT offers a wide range of platforms and has become a go-to option for many users, BUSD’s transparency and integration with the Binance ecosystem have made it an attractive alternative. Ultimately, the choice between USDT and BUSD depends on your specific needs, preferences, and the platforms you use.

| Feature | USDT | BUSD |

|---|---|---|

| Issuance | Tether Limited | Binance |

| Underlying Assets | Fiat currencies (primarily USD) | Fiat currencies (primarily USD) |

| Blockchain Platforms | Ethereum, Tron, Omni Layer | Binance Smart Chain |

|

|