Convert Dollar to USDT: A Comprehensive Guide

Are you looking to convert your dollars to Tether (USDT)? Whether you’re a seasoned cryptocurrency trader or a beginner exploring the world of digital assets, understanding how to convert your fiat currency to USDT is crucial. In this detailed guide, we’ll explore various methods, fees, and considerations to help you make an informed decision.

Understanding USDT

Before diving into the conversion process, it’s essential to understand what USDT is. Tether is a type of cryptocurrency that is backed by fiat currencies, primarily the US dollar. Each USDT token is equivalent to one US dollar, making it a stablecoin that offers a reliable value compared to volatile cryptocurrencies like Bitcoin or Ethereum.

Methods to Convert Dollar to USDT

There are several ways to convert your dollars to USDT, each with its own set of advantages and disadvantages. Let’s explore some of the most popular methods:

1. Cryptocurrency Exchanges

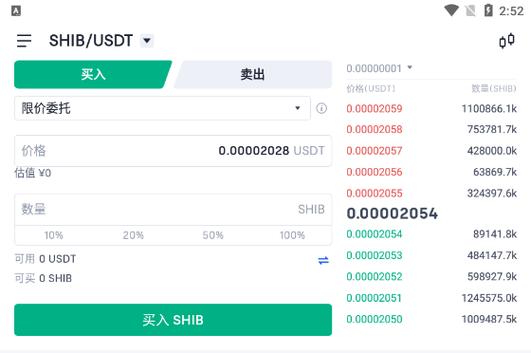

Cryptocurrency exchanges are one of the most common ways to convert dollars to USDT. These platforms allow users to buy, sell, and trade various cryptocurrencies, including USDT. Here’s how you can do it:

- Sign up for an account on a reputable cryptocurrency exchange.

- Complete the necessary verification process, which may include providing identification documents.

- Deposit your dollars into the exchange’s bank account or use a credit/debit card.

- Use the exchange’s trading interface to buy USDT using your deposited dollars.

- Withdraw your USDT to a cryptocurrency wallet of your choice.

Some popular cryptocurrency exchanges that support USDT conversions include Binance, Coinbase, Kraken, and Bitfinex.

2. Peer-to-Peer (P2P) Platforms

P2P platforms connect buyers and sellers directly, allowing you to convert your dollars to USDT without going through a centralized exchange. Here’s how you can do it:

- Sign up for a P2P platform like LocalBitcoins or Paxful.

- Create an account and complete the necessary verification process.

- Search for USDT sellers who accept dollars and review their ratings and reviews.

- Agree on the terms of the trade, including the price and payment method.

- Make the payment to the seller and receive your USDT in your wallet.

P2P platforms offer more flexibility in terms of payment methods and prices, but they also come with higher risks, such as the possibility of encountering fraudulent sellers.

3. Bank Transfers

Some cryptocurrency exchanges and wallet providers allow you to convert your dollars to USDT using a bank transfer. Here’s how you can do it:

- Choose an exchange or wallet provider that supports bank transfers.

- Complete the necessary verification process.

- Deposit your dollars into the exchange’s or wallet provider’s bank account.

- Wait for the bank transfer to clear, which may take a few days.

- Use the deposited funds to buy USDT on the exchange or transfer it to your wallet.

Bank transfers are a secure and reliable method, but they can be time-consuming and may incur additional fees.

Considerations When Converting Dollar to USDT

When converting your dollars to USDT, there are several factors to consider to ensure a smooth and cost-effective process:

1. Fees

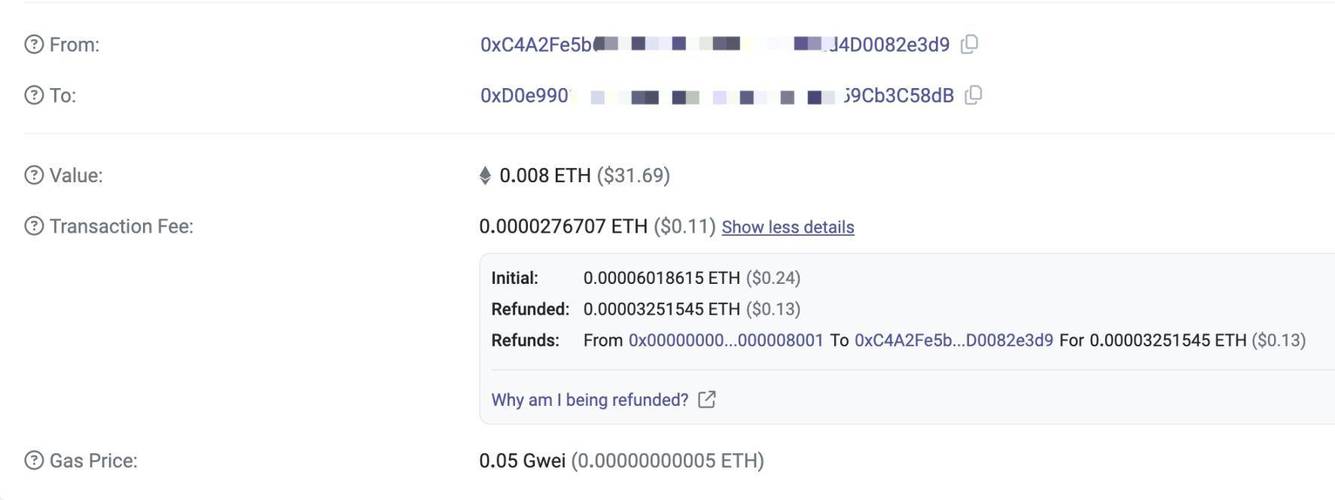

Most methods of converting dollars to USDT involve fees, which can vary depending on the platform or service you choose. Some common fees include:

- Exchange fees: These are charged by cryptocurrency exchanges for facilitating the trade.

- Transaction fees: These are charged for processing the transaction on the blockchain.

- Bank fees: Some exchanges or wallet providers may charge fees for bank transfers.

It’s essential to compare the fees of different platforms or services to find the most cost-effective option.

2. Security

When converting your dollars to USDT, it’s crucial to ensure the security of your funds. Here are some tips to keep in mind:

- Choose reputable platforms or services with a good track record of security.

- Use strong,