Understanding USDT: A Comprehensive Guide

USDT, also known as Tether USD, has become a prominent figure in the cryptocurrency world. As a stablecoin, it offers a unique blend of the benefits of cryptocurrencies and the stability of fiat currencies. In this article, we will delve into the intricacies of USDT, exploring its purpose, functionality, and the various aspects that make it a preferred choice for many users.

What is USDT?

USDT is a type of cryptocurrency that is designed to maintain a stable value relative to the US dollar. It is issued by Tether Limited, a financial services company based in the British Virgin Islands. The primary goal of USDT is to provide a reliable and stable digital currency that can be used for transactions, investments, and savings.

How does USDT Work?

USDT operates on the principle of 1:1 backing, meaning that for every USDT token in circulation, there is a corresponding amount of fiat currency, typically US dollars, held in reserve. This reserve is used to ensure that USDT can be redeemed for USD at a 1:1 ratio. The process of issuing USDT tokens is governed by smart contracts on blockchain platforms, such as the Ethereum network.

When you purchase USDT, you are essentially exchanging your fiat currency for a digital token that is backed by real money. This provides a level of security and stability that is not always present in other cryptocurrencies, which can be highly volatile in value.

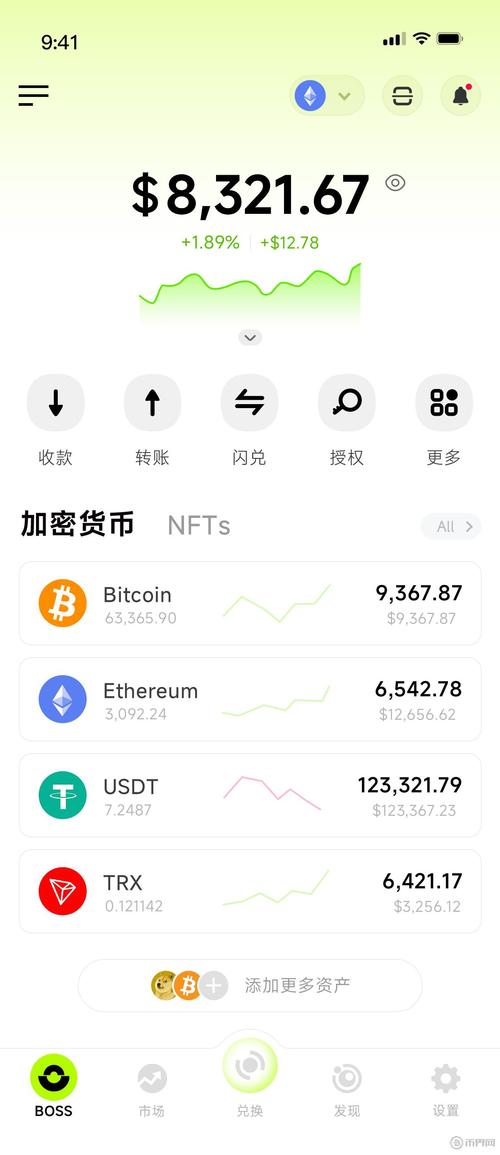

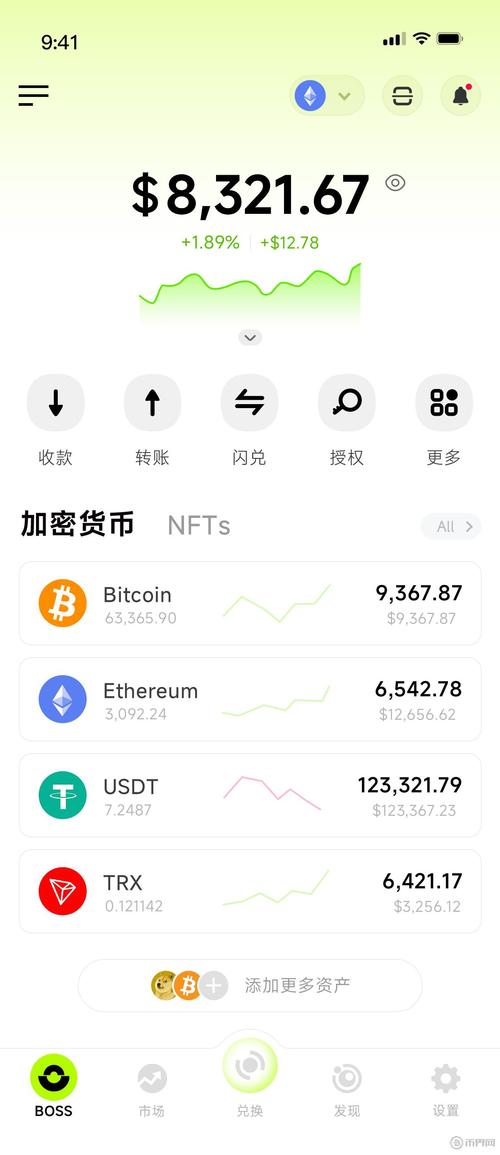

USDT in the Cryptocurrency Ecosystem

USDT plays a crucial role in the cryptocurrency ecosystem. It serves as a bridge between fiat currencies and cryptocurrencies, making it easier for users to buy and sell digital assets. Here are some key uses of USDT:

-

Exchange: USDT can be used to exchange between different cryptocurrencies, providing a stable value reference.

-

Payment: USDT can be used for online purchases, payments, and remittances, offering a fast and secure alternative to traditional banking systems.

-

Staking: Some cryptocurrency platforms allow users to stake USDT to earn rewards, providing an additional income stream.

-

Investment: USDT can be used to invest in various digital assets, including cryptocurrencies, stocks, and bonds, through various investment platforms.

Benefits of Using USDT

There are several benefits to using USDT:

-

Stability: USDT maintains a stable value relative to the US dollar, making it a reliable choice for users who want to avoid the volatility of other cryptocurrencies.

-

Transparency: Tether Limited is required to maintain a reserve of fiat currency for every USDT token in circulation, and this reserve is regularly audited by third-party auditors. This transparency helps to build trust among users.

-

Accessibility: USDT can be easily obtained through various exchanges and platforms, making it accessible to a wide range of users.

-

Speed: Transactions with USDT are typically faster than traditional banking systems, as they are processed on the blockchain.

Drawbacks of Using USDT

While USDT offers many benefits, there are also some drawbacks to consider:

-

Centralization: USDT is issued and managed by Tether Limited, which means that it is a centralized cryptocurrency. This can raise concerns about the potential for manipulation or control by the issuing company.

-

Lack of Privacy: Unlike some other cryptocurrencies, USDT does not offer a high level of privacy. Transactions with USDT are recorded on the blockchain, which can be accessed by anyone.

-

Regulatory Risks: As a cryptocurrency, USDT is subject to regulatory scrutiny in many countries. This can lead to potential legal and financial risks for users.

Conclusion

USDT has become an essential part of the cryptocurrency ecosystem, offering a stable and reliable alternative to traditional fiat currencies. While it has its drawbacks, the benefits of using USDT make it a popular choice for many users. Whether you are looking to exchange cryptocurrencies, make payments, or invest in digital assets, USDT is a versatile and valuable tool to have in your arsenal.

| Feature |

|---|