Understanding USDT Fluctuations on Binance

When it comes to trading cryptocurrencies, USDT (Tether) is often a stablecoin of choice. But does USDT fluctuate on Binance? Let’s delve into this question and explore the various factors that might affect its price volatility on the world’s largest cryptocurrency exchange.

What is USDT?

USDT is a type of stablecoin that is backed by fiat currencies, primarily the US dollar. It is designed to maintain a stable value, typically pegged at 1 USDT to 1 USD. This makes it a popular choice for traders looking to avoid the high volatility associated with other cryptocurrencies.

How does USDT work on Binance?

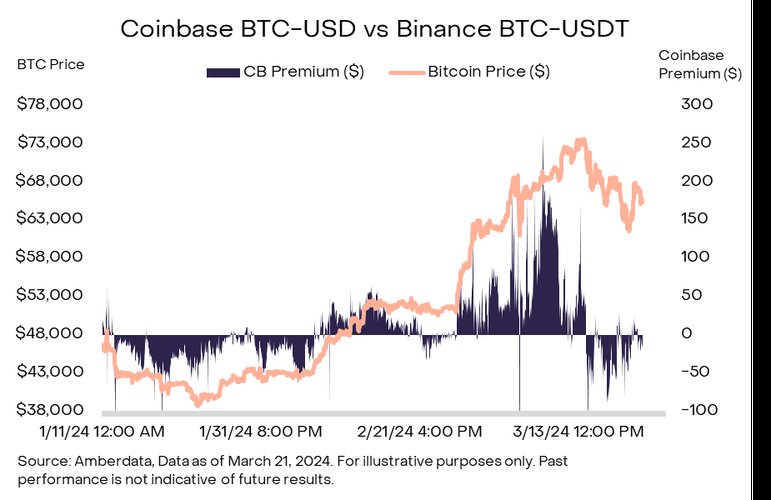

Binance, being one of the largest cryptocurrency exchanges, offers a wide range of trading pairs, including USDT. Traders can use USDT to trade other cryptocurrencies, or to convert between different digital assets. The stability of USDT on Binance is crucial for maintaining the overall trading experience.

Factors Affecting USDT Fluctuations on Binance

While USDT is designed to be stable, there are several factors that can cause its price to fluctuate on Binance:

| Factor | Description |

|---|---|

| Market Supply and Demand | Just like any other asset, the supply and demand for USDT can affect its price. If there is a high demand for USDT, its price might increase, and vice versa. |

| Market Sentiment | Traders’ sentiment towards the cryptocurrency market can also impact USDT’s price. For example, during times of market uncertainty, traders might flock to USDT as a safe haven, causing its price to rise. |

| Exchange Liquidity | The liquidity of USDT on Binance can influence its price. If there is a high volume of trading, the price might be more stable. However, during periods of low liquidity, price fluctuations can be more pronounced. |

| Regulatory Changes | Changes in regulations regarding cryptocurrencies can affect the stability of USDT. For instance, if a country imposes strict regulations on stablecoins, it might lead to a decrease in demand for USDT, causing its price to fluctuate. |

Monitoring USDT Price on Binance

Monitoring the price of USDT on Binance is essential for traders. Here are some tools and resources that can help:

- Binance’s Trading Page: Binance provides real-time data on USDT’s price, trading volume, and market depth.

- Third-party Exchanges: Some third-party exchanges offer additional tools and analytics for monitoring USDT’s price on Binance.

- News and Social Media: Keeping up with the latest news and social media updates can help traders stay informed about potential factors that might affect USDT’s price.

Conclusion

While USDT is designed to be a stablecoin, it is still subject to fluctuations on Binance. Understanding the factors that can affect its price can help traders make informed decisions. By monitoring the market and staying informed, traders can navigate the world of USDT trading on Binance with greater confidence.