Dai, USDC, USDT: A Comprehensive Guide to Understanding These Cryptocurrencies

When it comes to the world of cryptocurrencies, Dai, USDC, and USDT are three of the most widely recognized and utilized digital assets. Each of these tokens serves a unique purpose and plays a significant role in the crypto ecosystem. In this article, we will delve into the details of these three cryptocurrencies, exploring their features, benefits, and how they differ from one another.

Understanding Dai

Dai is a decentralized cryptocurrency that operates on the Ethereum blockchain. It is known for its stability and is often referred to as a “stablecoin.” Unlike other cryptocurrencies, Dai aims to maintain a value that is pegged to the US dollar, making it an attractive option for those looking to avoid the volatility associated with traditional cryptocurrencies.

One of the key features of Dai is its decentralized nature. It is backed by a basket of other cryptocurrencies, including ETH, BTC, and BAT, which helps to ensure its stability. The Dai system is designed to automatically adjust the supply of Dai tokens to maintain its value, making it a unique and innovative approach to stablecoin creation.

Exploring USDC

USDC, or USD Coin, is another popular stablecoin that is pegged to the US dollar. Unlike Dai, USDC is fully backed by fiat currency reserves, which are held in various financial institutions. This backing provides a high level of trust and security for users, as the value of USDC is directly tied to the US dollar.

USDC is often used for transactions, payments, and as a store of value. Its integration with various exchanges and payment platforms has made it a go-to choice for many users. Additionally, USDC is governed by a consortium of financial institutions, which helps to ensure its compliance with regulatory standards and financial regulations.

Understanding USDT

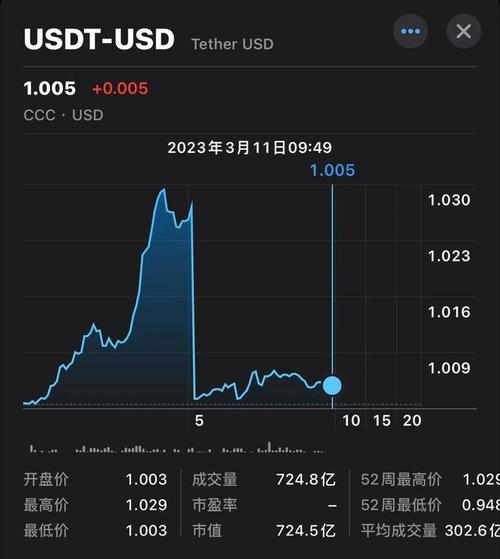

USDT, or Tether, is one of the oldest and most widely used stablecoins. It is also pegged to the US dollar and is backed by fiat currency reserves. USDT is often used for trading on cryptocurrency exchanges, as it provides a stable value that can be easily converted to and from other cryptocurrencies.

One of the key advantages of USDT is its liquidity. It is available on numerous exchanges and can be used for a wide range of transactions. Additionally, USDT is often used as a medium of exchange, allowing users to trade between different cryptocurrencies without the need for converting to fiat currency.

Comparing Dai, USDC, and USDT

While Dai, USDC, and USDT all share the common goal of providing stability and a peg to the US dollar, there are some notable differences between them.

| Cryptocurrency | Backing | Decentralization | Use Cases |

|---|---|---|---|

| Dai | Cryptocurrency basket | High | Stablecoin transactions, lending, and borrowing |

| USDC | Fiat currency reserves | Low | Transactions, payments, and as a store of value |

| USDT | Fiat currency reserves | Low | Trading, exchanges, and medium of exchange |

Dai is the most decentralized of the three, with a system that automatically adjusts its supply to maintain its value. USDC and USDT, on the other hand, are backed by fiat currency reserves and are less decentralized. USDC is governed by a consortium of financial institutions, while USDT is issued by Tether Limited.

When it comes to use cases, Dai is often used for lending and borrowing, as well as for stablecoin transactions. USDC is widely used for transactions, payments, and as a store of value. USDT is primarily used for trading on cryptocurrency exchanges and as a medium of exchange.

Conclusion

Dai, USDC, and USDT are three of the most important stablecoins in the cryptocurrency market. Each offers its own unique set of features and benefits, making them suitable for different use cases. Whether you are looking for stability, liquidity, or a decentralized solution, these three stablecoins are worth considering.