Understanding Commercial Paper USDT: A Comprehensive Guide

Commercial paper USDT, often referred to as stablecoin commercial paper, has emerged as a significant financial instrument in the digital currency landscape. In this detailed guide, we will explore what commercial paper USDT is, how it works, its benefits, risks, and its role in the broader financial ecosystem.

What is Commercial Paper USDT?

Commercial paper USDT is a type of short-term debt instrument issued by corporations to raise funds for their short-term financing needs. Unlike traditional commercial paper, which is denominated in fiat currencies, commercial paper USDT is denominated in Tether (USDT), a popular stablecoin that is pegged to the US dollar.

How Does Commercial Paper USDT Work?

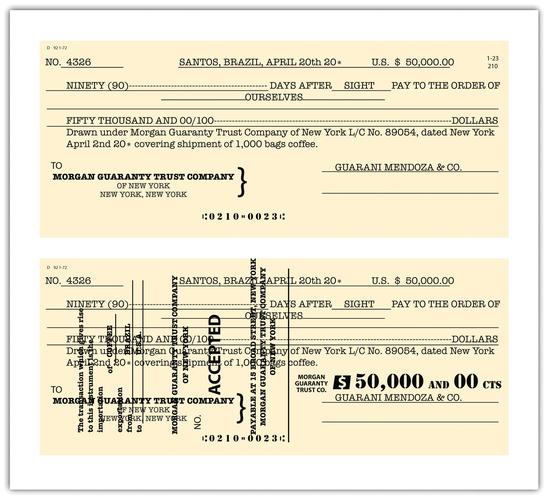

When a corporation needs to raise funds quickly, it can issue commercial paper USDT. Investors purchase these papers, and the corporation uses the funds to meet its short-term obligations. The papers typically have a maturity period of less than a year, ranging from a few days to a few months.

Here’s a step-by-step breakdown of how commercial paper USDT works:

| Step | Description |

|---|---|

| 1. | The corporation decides to issue commercial paper USDT. |

| 2. | The corporation sets the terms of the paper, including the amount, maturity, and interest rate. |

| 3. | The corporation sells the paper to investors, who can be institutional or retail. |

| 4. | The corporation uses the funds to meet its short-term obligations. |

| 5. | At maturity, the corporation repays the principal amount to the investors. |

Benefits of Commercial Paper USDT

There are several benefits of using commercial paper USDT:

-

Accessibility: Commercial paper USDT is accessible to a broader range of investors, including those who prefer to invest in digital currencies.

-

Transparency: The process of issuing and trading commercial paper USDT is transparent, as it operates on blockchain technology.

-

Speed: The issuance and trading of commercial paper USDT are faster compared to traditional methods.

-

Lower Costs: The cost of issuing and trading commercial paper USDT is generally lower than traditional methods.

Risks Associated with Commercial Paper USDT

While commercial paper USDT offers several benefits, it also comes with certain risks:

-

Market Risk: The value of USDT can fluctuate, which may affect the value of commercial paper USDT.

-

Liquidity Risk: There may be liquidity issues if investors want to sell their commercial paper USDT before maturity.

-

Credit Risk: The risk that the corporation may default on its obligations.

Role in the Financial Ecosystem

Commercial paper USDT plays a crucial role in the financial ecosystem by providing a new avenue for corporations to raise funds and for investors to invest in digital currencies. It also contributes to the growth of the stablecoin market and the broader adoption of digital currencies in the traditional financial system.

Conclusion

Commercial paper USDT is a versatile and innovative financial instrument that offers numerous benefits while also presenting certain risks. As the digital currency landscape continues to evolve, commercial paper USDT is likely to play an increasingly significant role in the financial ecosystem.