Understanding axs.usdt: A Comprehensive Guide

Are you curious about axs.usdt and what it entails? Look no further. This article delves into the intricacies of axs.usdt, providing you with a detailed and multi-dimensional overview. Whether you’re a seasoned investor or a beginner in the cryptocurrency space, this guide will equip you with the knowledge you need to navigate the world of axs.usdt.

What is axs.usdt?

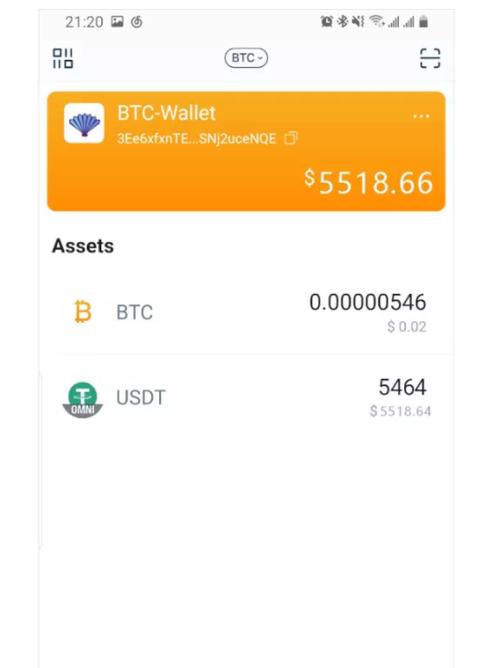

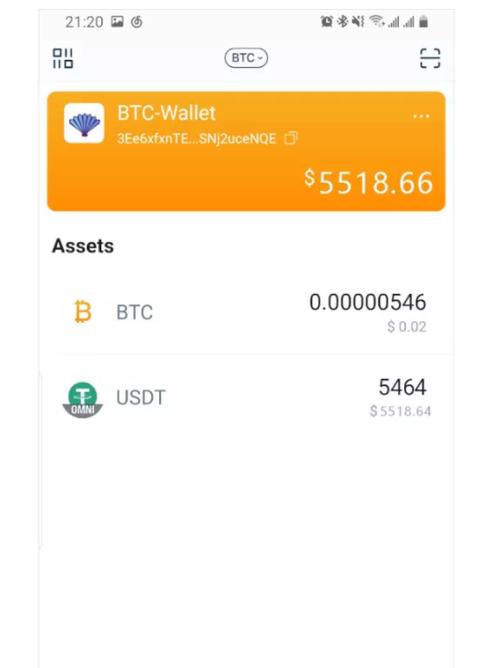

axs.usdt is a cryptocurrency that operates on the Binance Smart Chain (BSC). It is an ERC20 token, which means it is built on the Ethereum blockchain and can be traded on various decentralized exchanges. axs.usdt is designed to offer users a stable and secure investment opportunity, as it is backed by the US dollar (USD). This backing ensures that the value of axs.usdt remains relatively stable, making it an attractive option for those looking to diversify their cryptocurrency portfolio.

How Does axs.usdt Work?

axs.usdt operates through a decentralized finance (DeFi) platform, which allows users to engage in various financial activities, such as lending, borrowing, and trading. The platform is built on the Binance Smart Chain, which is known for its high throughput and low transaction fees. Here’s a breakdown of how axs.usdt works:

-

Token Creation: axs.usdt is created by locking USD in a reserve wallet. This reserve wallet is managed by a group of validators who ensure the stability of the token.

-

Token Distribution: Once the USD is locked, axs.usdt tokens are minted and distributed to users. These tokens can then be traded on various exchanges.

-

Staking and Yield Farming: Users can stake their axs.usdt tokens to earn rewards. This process is known as yield farming and is a popular way to generate income in the DeFi space.

-

Trading and Liquidity: axs.usdt can be traded on various exchanges, providing liquidity to the market. This liquidity allows users to easily buy and sell the token.

Benefits of axs.usdt

axs.usdt offers several benefits to users, making it a compelling investment option:

-

Stability: Being backed by the US dollar, axs.usdt provides stability to investors, as its value is less likely to be affected by market volatility.

-

Low Transaction Fees: axs.usdt operates on the Binance Smart Chain, which is known for its low transaction fees. This makes it an affordable option for users looking to engage in DeFi activities.

-

High Throughput: The Binance Smart Chain offers high throughput, allowing for fast and efficient transactions. This is particularly beneficial for users looking to engage in high-frequency trading.

-

Decentralization: axs.usdt is a decentralized token, which means it is not controlled by any single entity. This decentralization ensures transparency and security in the platform’s operations.

Risks Associated with axs.usdt

While axs.usdt offers several benefits, it’s important to be aware of the risks involved:

-

Market Volatility: Although axs.usdt is backed by the US dollar, it is still subject to market volatility. The value of the token can fluctuate, and users should be prepared for potential losses.

-

Smart Contract Risks: As axs.usdt is built on the Binance Smart Chain, it is subject to smart contract risks. If a smart contract is compromised, it could lead to the loss of funds.

-

Regulatory Risks: Cryptocurrency regulations are still evolving, and axs.usdt may be subject to regulatory changes that could impact its value and usability.

axs.usdt vs. Other Stablecoins

When comparing axs.usdt to other stablecoins, it’s important to consider several factors:

| Stablecoin | Backing | Blockchain | Transaction Fees |

|---|---|---|---|

| axs.usdt | USD | Binance Smart Chain | Low |