Understanding the BTCH/USDT Trading Pair

When it comes to cryptocurrency trading, the BTCH/USDT pair is a significant trading instrument. In this article, we will delve into the details of this trading pair, exploring its characteristics, market dynamics, and trading strategies.

What is BTCH?

BTCH, short for Bitcoin Cash, is a cryptocurrency that was forked from Bitcoin in 2017. It was created to address some of the scalability issues that Bitcoin faced at the time. Bitcoin Cash aims to increase the block size limit, allowing for more transactions to be processed in a single block.

Understanding USDT

USDT, or Tether, is a stablecoin that is pegged to the US dollar. It is designed to provide a stable value, making it an attractive option for traders who want to avoid the volatility associated with other cryptocurrencies. USDT is often used as a medium of exchange in the cryptocurrency market.

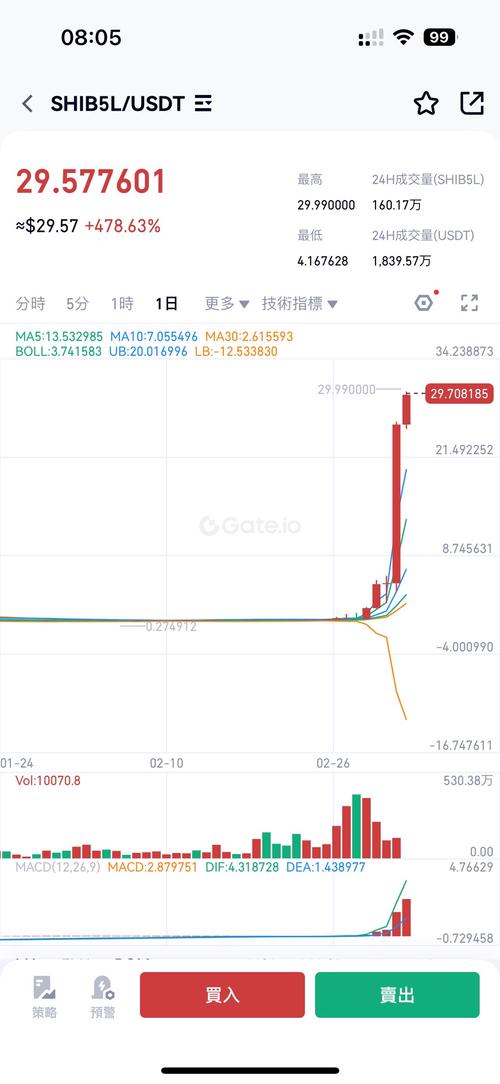

Market Dynamics of BTCH/USDT

The BTCH/USDT trading pair is influenced by various factors, including market sentiment, technical analysis, and fundamental news. Here are some key aspects to consider:

| Factor | Description |

|---|---|

| Market Sentiment | Traders’ perceptions and emotions towards the market can significantly impact the price of BTCH/USDT. Positive sentiment can lead to increased buying pressure, while negative sentiment can result in selling pressure. |

| Technical Analysis | Technical analysis involves studying historical price and volume data to identify patterns and trends. Traders use various indicators and chart patterns to make informed trading decisions. |

| Fundamental News | News related to Bitcoin Cash, such as updates on its development, regulatory changes, or partnerships, can have a significant impact on the BTCH/USDT trading pair. |

Trading Strategies for BTCH/USDT

When trading the BTCH/USDT pair, it is essential to have a well-defined strategy. Here are some common trading strategies:

-

Day Trading: This involves buying and selling BTCH/USDT within the same trading day to capitalize on short-term price movements.

-

Swing Trading: Swing traders hold positions for a few days to weeks, aiming to capture larger price movements.

-

Position Trading: Position traders hold positions for an extended period, sometimes even months or years, to benefit from long-term price trends.

Risks and Considerations

Trading the BTCH/USDT pair, like any other cryptocurrency trading, comes with its own set of risks. Here are some key considerations:

-

Market Volatility: Cryptocurrencies are known for their high volatility, which can lead to significant price swings in a short period.

-

Liquidity: The liquidity of the BTCH/USDT pair can vary, which may affect the ability to enter or exit positions at desired prices.

-

Regulatory Changes: Changes in regulations can impact the market dynamics and the value of BTCH and USDT.

Conclusion

Trading the BTCH/USDT pair requires a thorough understanding of the market dynamics, trading strategies, and associated risks. By staying informed and employing a well-defined strategy, traders can navigate the complexities of this trading pair and potentially achieve profitable outcomes.