In the dynamic landscape of cryptocurrency investment, understanding the market trends is crucial. The alternative cryptocurrency season indicator, often referred to as the altcoin season index, serves as a valuable tool for investors looking to navigate this ever-changing environment. This article will delve into what the altcoin season index is and how it can influence investment decisions.

What is the Altcoin Season Index?

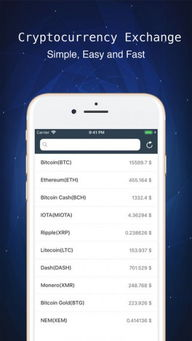

The alternative cryptocurrency season index is a metric that helps investors gauge whether altcoins are outperforming Bitcoin in the market. This index is vital for traders and investors as it indicates the general sentiment toward altcoins compared to the market leader, Bitcoin. A period characterized as altcoin season typically means that the majority of altcoins experience price appreciation over Bitcoin, making it an attractive time for investing in alternative cryptocurrencies.

How is the Altcoin Season Index Calculated?

The altcoin season index is calculated based on the performance of the top 50 cryptocurrencies by market capitalization compared to Bitcoin. The index analyzes the price movements and trends of these altcoins over a specified time frame, typically a few weeks or months. When altcoins lead in price increases, indicating that they are rising significantly compared to Bitcoin, the index climbs, suggesting the onset of altcoin season.

Importance of Monitoring the Altcoin Season Index

Investors should closely monitor the altcoin season index as it plays a pivotal role in investment strategy. Understanding the timing of altcoin cycles can yield substantial returns, especially when trading altcoins during peak market periods. Additionally, recognizing altcoin seasons can aid in risk management, allowing investors to adjust their portfolios to maximize gains and minimize losses.

Indicators of Altcoin Season

Several indicators signify the arrival of altcoin season. These include a sharp increase in the altcoin market cap compared to Bitcoin, rising trading volumes in altcoins, and the overall market sentiment shifting towards altcoins. Moreover, patterns of Bitcoin dominance decreasing while altcoin prices surge are also telltale signs that an altcoin season is underway.

In conclusion, the alternative cryptocurrency season index is a crucial tool for investors navigating the complex world of cryptocurrency markets. By understanding how this index operates and monitoring its movements, investors can make informed decisions that can lead to significant financial benefits during periods when altcoins outperform Bitcoin. Keeping track of the altcoin season index will ensure that traders capitalize on the volatile yet lucrative nature of cryptocurrency trading.