In the rapidly evolving cryptocurrency landscape, arbitrage trading has become a popular strategy among traders looking to take advantage of price discrepancies across different exchanges. KuCoin, a well-known cryptocurrency exchange, provides unique opportunities for arbitrage, particularly with USDT (Tether

), a stablecoin widely used in the crypto market. This article delves into the essentials of KuCoin arbitrage and provides insights on how to effectively engage in USDT arbitrage trading.

Understanding KuCoin and USDT Arbitrage

Arbitrage refers to the practice of buying an asset in one market and simultaneously selling it in another at a higher price, capitalizing on the price difference. KuCoin is a popular platform for traders due to its extensive range of supported cryptocurrencies and trading pairs, including USDT. USDT acts as a bridge for traders, enabling them to enter and exit positions quickly without exposing themselves to excessive volatility, which is prevalent in many other cryptocurrencies.

Engaging in USDT arbitrage involves monitoring price movements on KuCoin compared to other exchanges. For instance, if USDT is trading at a lower price on KuCoin than on Binance, a trader can purchase USDT on KuCoin and sell it for a profit on Binance, leveraging the difference in prices. Successful arbitrage trading depends on a few critical factors, including timing, trading fees, and market liquidity.

Key Benefits of USDT Arbitrage on KuCoin

Participating in USDT arbitrage can yield several benefits for traders, including:

1. Reduced Market Risk: Since USDT is pegged to the US dollar, it minimizes the risks associated with trading more volatile cryptocurrencies. This stability can enhance a trader’s confidence when implementing short-term trades.

2. Quick Transactions: KuCoin’s liquidity allows for rapid transactions, which is essential when engaging in arbitrage trading to exploit minuscule price discrepancies effectively.

3. Diverse Opportunities: The availability of various trading pairs on KuCoin grants traders multiple arbitrage opportunities across different cryptocurrencies in addition to USDT.

Strategies for Effective USDT Arbitrage on KuCoin

To maximize profits while minimizing risks, consider the following strategies:

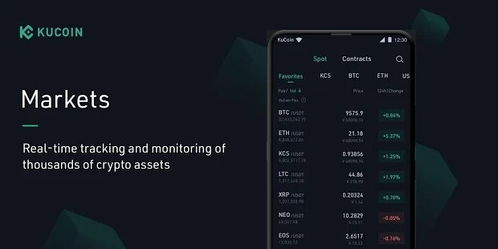

1. Real-Time Monitoring: Utilize cryptocurrency price tracking tools or software to continuously monitor price fluctuations across exchanges. This will help identify suitable arbitrage opportunities quickly.

2. Calculate Trading Fees: Before executing an arbitrage trade, ensure that fees from both exchanges do not exceed the expected profit. Calculate potential profits after all expenses are accounted for.

3. Start Small: If you are new to arbitrage trading, begin with smaller amounts to familiarize yourself with the process and strategies without incurring significant losses.

In conclusion, understanding the intricacies of KuCoin arbitrage with USDT can present traders with profitable opportunities in the burgeoning cryptocurrency market. By implementing effective strategies and staying informed about market movements, traders can optimize their gains while managing risks.

Arbitrage trading on KuCoin, especially with USDT, offers promising avenues for profit-making. By leveraging price discrepancies across exchanges and implementing well-thought-out strategies, traders can navigate the complexities of the cryptocurrency market successfully, enhancing their overall trading portfolio.